Authors

Summary

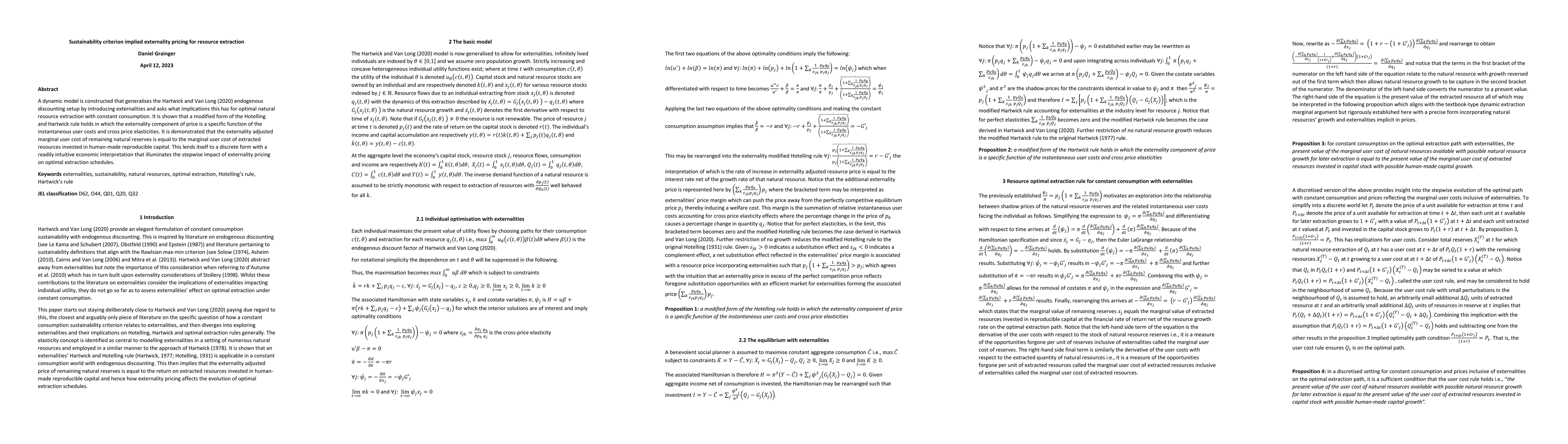

A dynamic model is constructed that generalises the Hartwick and Van Long (2020) endogenous discounting setup by introducing externalities and asks what implications this has for optimal natural resource extraction with constant consumption. It is shown that a modified form of the Hotelling and Hartwick rule holds in which the externality component of price is a specific function of the instantaneous user costs and cross price elasticities. It is demonstrated that the externality adjusted marginal user cost of remaining natural reserves is equal to the marginal user cost of extracted resources invested in human-made reproducible capital. This lends itself to a discrete form with a readily intuitive economic interpretation that illuminates the stepwise impact of externality pricing on optimal extraction schedules.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInternalizing sensing externality via matching and pricing for drive-by sensing taxi fleets

Ke Han, Shenglin Liu, Ruijie Li et al.

Market-Implied Sustainability: Insights from Funds' Portfolio Holdings

Davide Lauria, Rosella Giacometti, Gabriele Torri et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)