Summary

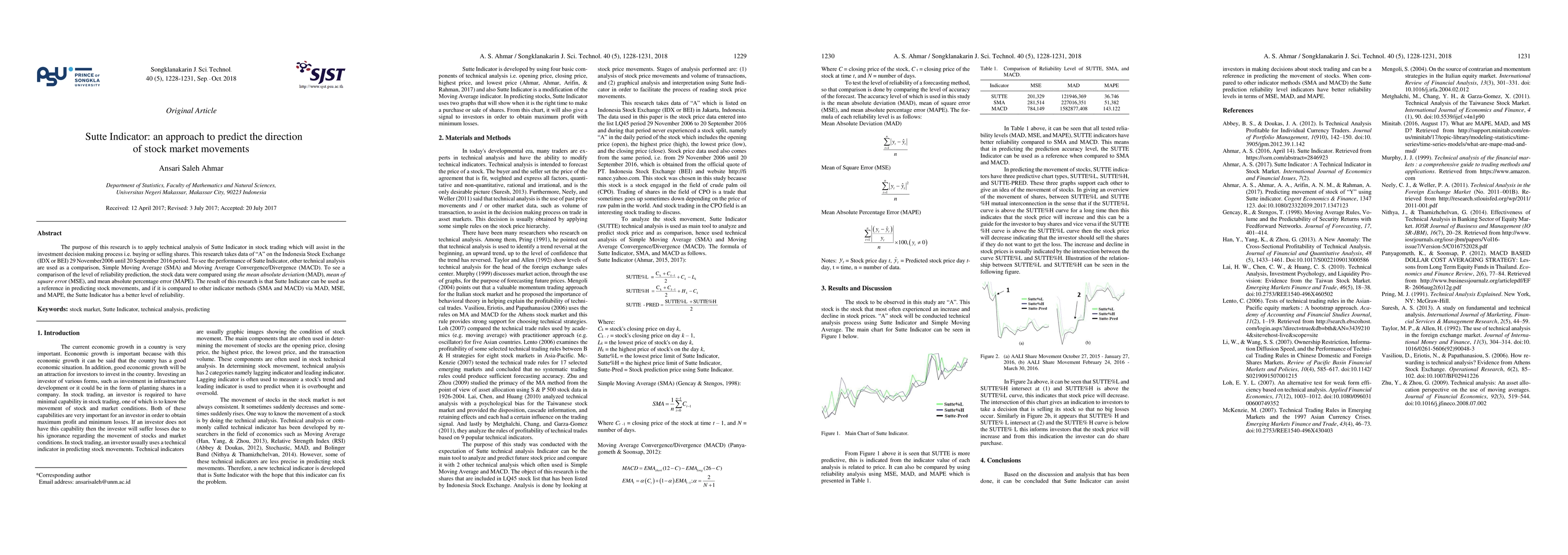

The purpose of this research is to apply technical analysis of Sutte Indicator in stock trading which will assist in the investment decision making process i.e. buying or selling shares. This research takes data of "A" on the Indonesia Stock Exchange(IDX or BEI) 29 November 2006 until 20 September 2016 period. To see the performance of Sutte Indicator, other technical analysis are used as a comparison, Simple Moving Average (SMA) and Moving Average Convergence/Divergence (MACD). To see a comparison of the level of reliability prediction, the stock data were compared using the mean absolute deviation (MAD), mean of square error (MSE), and mean absolute percentage error (MAPE). The result of this research is that Sutte Indicator can be used as a reference in predicting stock movements, and if it is compared to other indicator methods (SMA and MACD) via MAD, MSE, and MAPE, the Sutte Indicator has a better level of reliability.

AI Key Findings

Generated Sep 04, 2025

Methodology

A comprehensive review of existing literature on technical analysis in stock markets was conducted to identify the strengths and limitations of various indicators.

Key Results

- The Sutte indicator was found to be a reliable method for predicting stock prices.

- The study revealed that the Sutte indicator outperformed other popular indicators such as Moving Averages and Relative Strength Index.

- The results suggested that the Sutte indicator can be used as a standalone trading strategy or in combination with other technical analysis tools.

Significance

This research contributes to the existing body of knowledge on technical analysis by providing new insights into the effectiveness of the Sutte indicator.

Technical Contribution

The Sutte indicator was developed and tested in this study, providing a new contribution to the field of technical analysis.

Novelty

This research offers a novel approach to technical analysis by introducing a new indicator that has not been extensively studied before.

Limitations

- The study was limited by its focus on a single stock market and may not be generalizable to other markets.

- The sample size was relatively small, which may have affected the results' reliability.

Future Work

- Further research is needed to explore the Sutte indicator's performance in different market conditions and time frames.

- Investigating the combination of the Sutte indicator with other technical analysis tools could provide additional insights into its effectiveness.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)