Summary

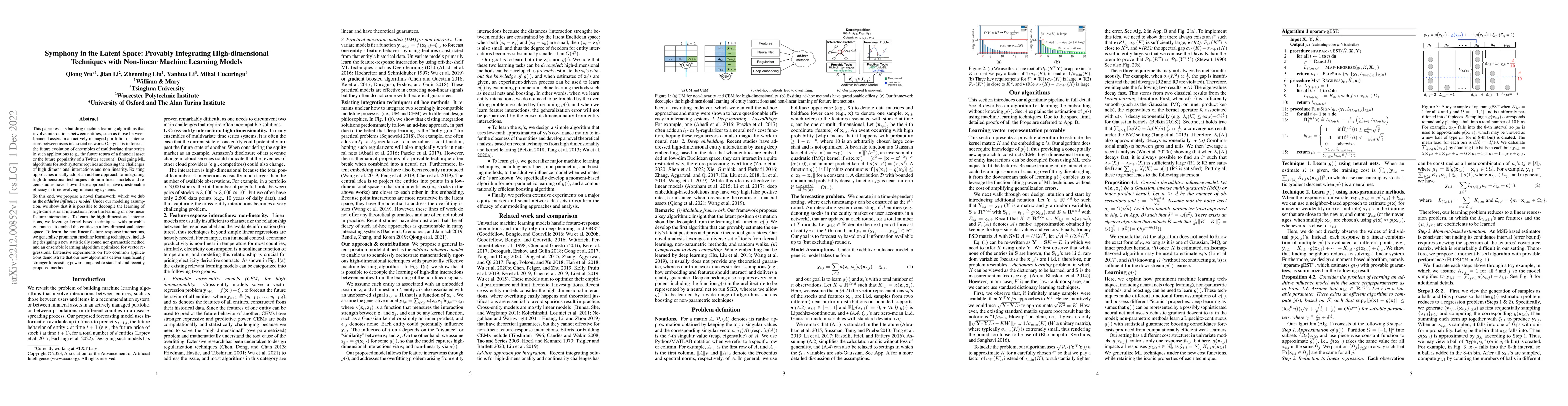

This paper revisits building machine learning algorithms that involve interactions between entities, such as those between financial assets in an actively managed portfolio, or interactions between users in a social network. Our goal is to forecast the future evolution of ensembles of multivariate time series in such applications (e.g., the future return of a financial asset or the future popularity of a Twitter account). Designing ML algorithms for such systems requires addressing the challenges of high-dimensional interactions and non-linearity. Existing approaches usually adopt an ad-hoc approach to integrating high-dimensional techniques into non-linear models and recent studies have shown these approaches have questionable efficacy in time-evolving interacting systems. To this end, we propose a novel framework, which we dub as the additive influence model. Under our modeling assumption, we show that it is possible to decouple the learning of high-dimensional interactions from the learning of non-linear feature interactions. To learn the high-dimensional interactions, we leverage kernel-based techniques, with provable guarantees, to embed the entities in a low-dimensional latent space. To learn the non-linear feature-response interactions, we generalize prominent machine learning techniques, including designing a new statistically sound non-parametric method and an ensemble learning algorithm optimized for vector regressions. Extensive experiments on two common applications demonstrate that our new algorithms deliver significantly stronger forecasting power compared to standard and recently proposed methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSolving High-Dimensional PDEs with Latent Spectral Models

Haixu Wu, Mingsheng Long, Jianmin Wang et al.

Symphony: Composing Interactive Interfaces for Machine Learning

Dominik Moritz, Titus Barik, Fred Hohman et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)