Summary

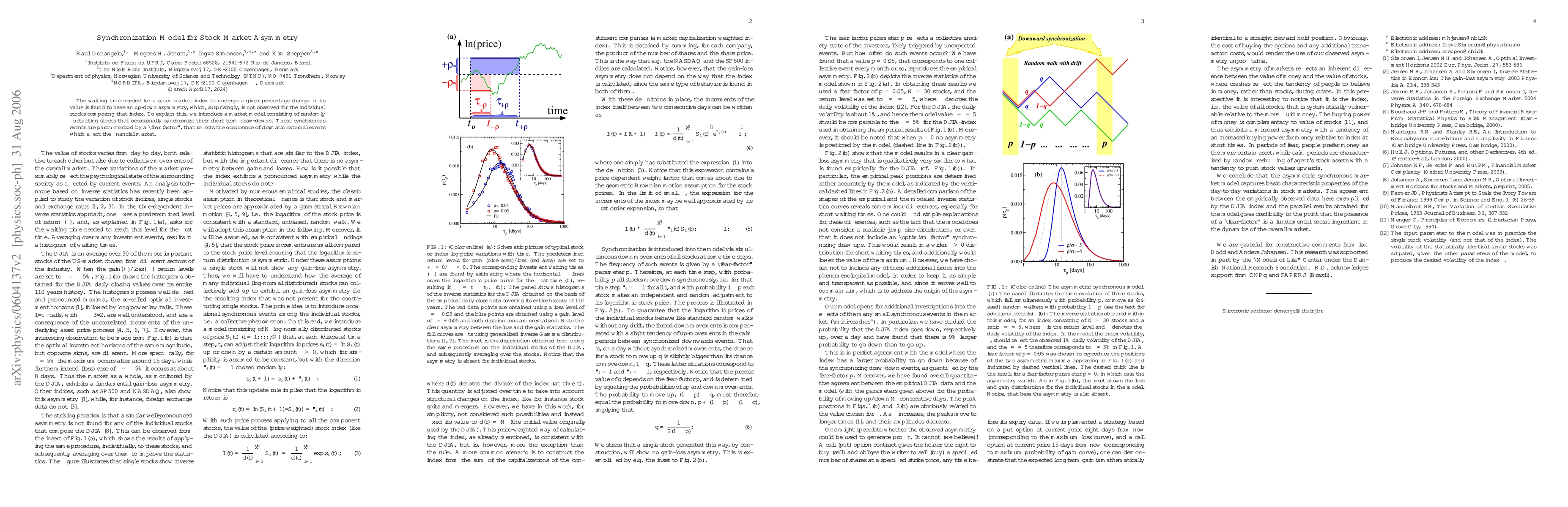

The waiting time needed for a stock market index to undergo a given percentage change in its value is found to have an up-down asymmetry, which, surprisingly, is not observed for the individual stocks composing that index. To explain this, we introduce a market model consisting of randomly fluctuating stocks that occasionally synchronize their short term draw-downs. These synchronous events are parameterized by a ``fear factor'', that reflects the occurrence of dramatic external events which affect the financial market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)