Summary

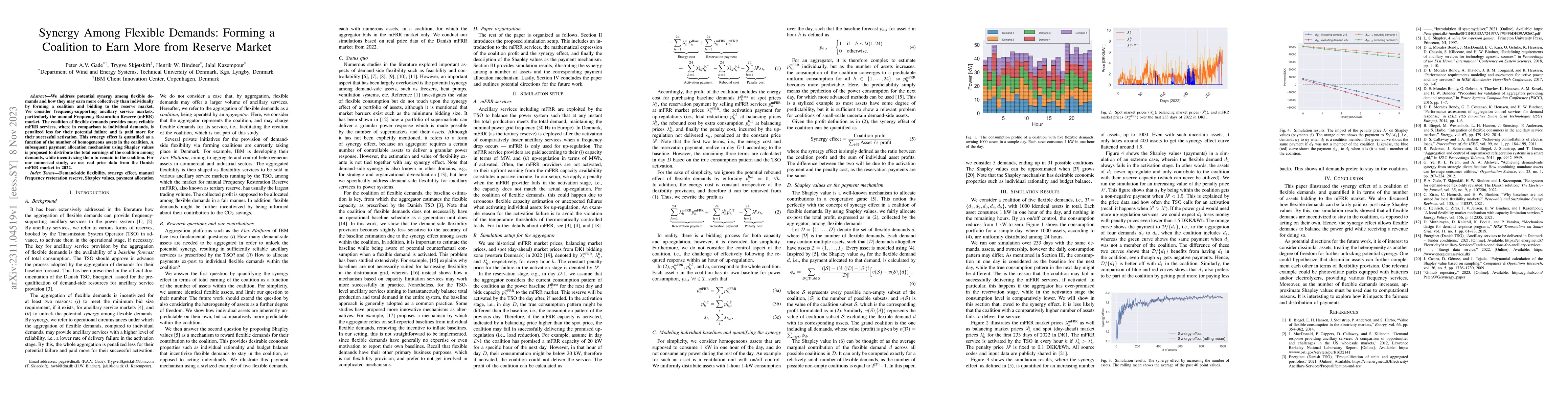

We address potential synergy among flexible demands and how they may earn more collectively than individually by forming a coalition and bidding to the reserve market. We consider frequency-supporting ancillary service markets, particularly the manual Frequency Restoration Reserve (mFRR) market. The coalition of flexible demands provides more reliable mFRR services, where in comparison to individual demands, is penalized less for their potential failure and is paid more for their successful activation. This synergy effect is quantified as a function of the number of homogeneous assets in the coalition. A subsequent payment allocation mechanism using Shapley values is proposed to distribute the total earnings of the coalition among demands, while incentivizing them to remain in the coalition. For our numerical study, we use real price data from the Danish mFRR market in 2022.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)