Summary

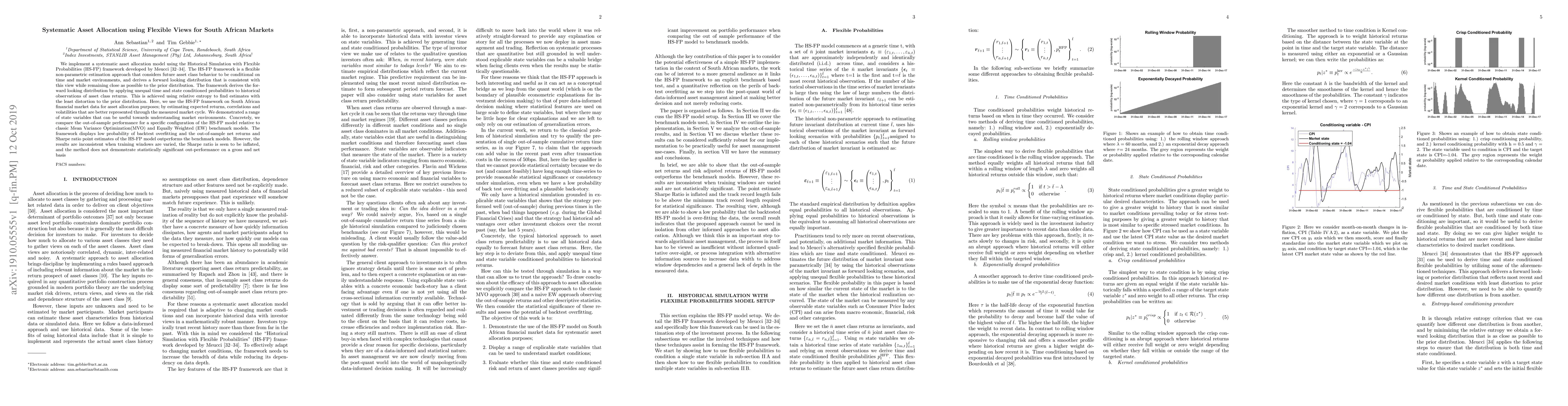

We implement a systematic asset allocation model using the Historical Simulation with Flexible Probabilities (HS-FP) framework developed by Meucci. The HS-FP framework is a flexible non-parametric estimation approach that considers future asset class behavior to be conditional on time and market environments, and derives a forward looking distribution that is consistent with this view while remaining close as possible to the prior distribution. The framework derives the forward looking distribution by applying unequal time and state conditioned probabilities to historical observations of asset class returns. This is achieved using relative entropy to find estimates with the least distortion to the prior distribution. Here, we use the HS-FP framework on South African financial market data for asset allocation purposes; by estimating expected returns, correlations and volatilities that are better represented through the measured market cycle. We demonstrated a range of state variables that can be useful towards understanding market environments. Concretely, we compare the out-of-sample performance for a specific configuration of the HS-FP model relative to classic Mean Variance Optimization(MVO) and Equally Weighted (EW) benchmark models. The framework displays low probability of backtest overfitting and the out-of-sample net returns and Sharpe ratio point estimates of the HS-FP model outperforms the benchmark models. However, the results are inconsistent when training windows are varied, the Sharpe ratio is seen to be inflated, and the method does not demonstrate statistically significant out-performance on a gross and net basis.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research implements a systematic asset allocation model using the Historical Simulation with Flexible Probabilities (HS-FP) framework, developed by Meucci. This non-parametric estimation approach derives forward-looking distributions conditional on time and market environments, using relative entropy to minimize distortion from the prior distribution.

Key Results

- The HS-FP model outperforms classic Mean Variance Optimization (MVO) and Equally Weighted (EW) benchmark models in terms of out-of-sample net returns and Sharpe ratio point estimates.

- However, the results are inconsistent when training windows are varied, and the Sharpe ratio is seen to be inflated.

- The method does not demonstrate statistically significant out-performance on a gross and net basis.

- Multiple state variables, including macroeconomic, risk, and trend-based categories, are shown to be useful in understanding market environments.

- The study uses monthly data of five asset classes and ten state variables for approximately 19 years (Feb 1998 to Dec 2017).

Significance

This research is significant as it proposes a flexible asset allocation model for South African markets, which could potentially improve investment decision-making by considering future asset class behavior conditional on time and market environments.

Technical Contribution

The paper's main technical contribution is the application of the HS-FP framework to South African financial market data for asset allocation purposes, providing a forward-looking distribution that is consistent with measured market cycles.

Novelty

The novelty of this work lies in its application of the HS-FP framework to South African markets, offering a flexible and non-parametric estimation approach that considers future asset class behavior conditional on time and market environments.

Limitations

- The study's findings are inconsistent when training windows are varied, raising questions about the model's robustness.

- The method does not demonstrate statistically significant out-performance on a gross and net basis, indicating potential limitations in practical application.

Future Work

- Future research could focus on improving the model's robustness by addressing inconsistencies in results across varying training windows.

- Exploring additional state variables or alternative conditioning methods could further enhance the model's performance and applicability.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Geometric Approach To Asset Allocation With Investor Views

Alexandre V. Antonov, Koushik Balasubramanian, Alexander Lipton et al.

No citations found for this paper.

Comments (0)