Summary

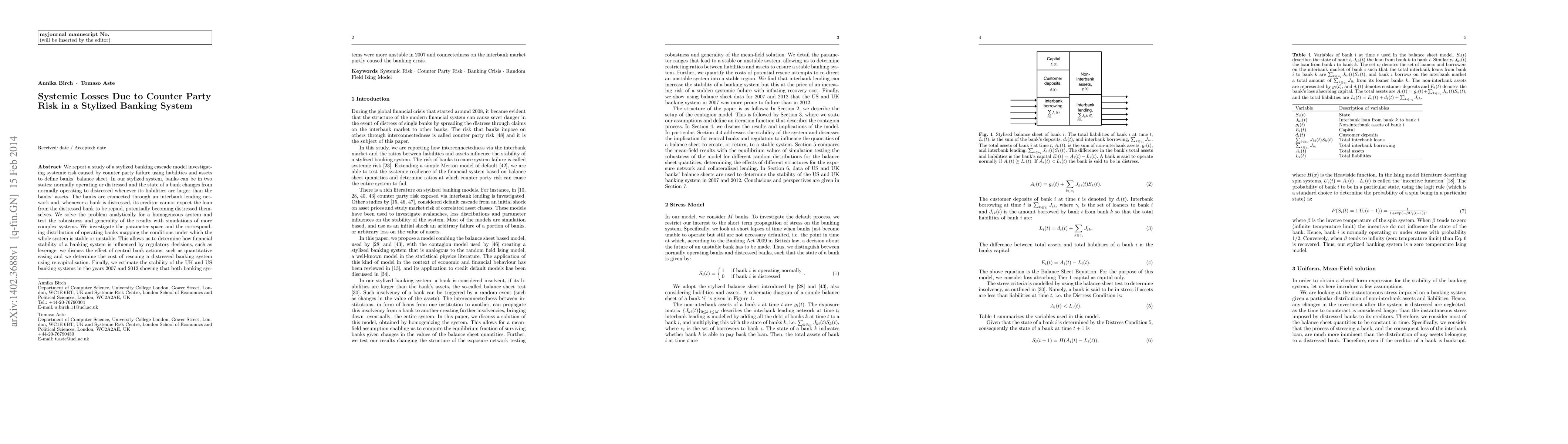

We report a study of a stylized banking cascade model investigating systemic risk caused by counter party failure using liabilities and assets to define banks' balance sheet. In our stylized system, banks can be in two states: normally operating or distressed and the state of a bank changes from normally operating to distressed whenever its liabilities are larger than the banks' assets. The banks are connected through an interbank lending network and, whenever a bank is distressed, its creditor cannot expect the loan from the distressed bank to be repaid, potentially becoming distressed themselves. We solve the problem analytically for a homogeneous system and test the robustness and generality of the results with simulations of more complex systems. We investigate the parameter space and the corresponding distribution of operating banks mapping the conditions under which the whole system is stable or unstable. This allows us to determine how financial stability of a banking system is influenced by regulatory decisions, such as leverage; we discuss the effect of central bank actions, such as quantitative easing and we determine the cost of rescuing a distressed banking system using re-capitalisation. Finally, we estimate the stability of the UK and US banking systems in the years 2007 and 2012 showing that both banking systems were more unstable in 2007 and connectedness on the interbank market partly caused the banking crisis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)