Summary

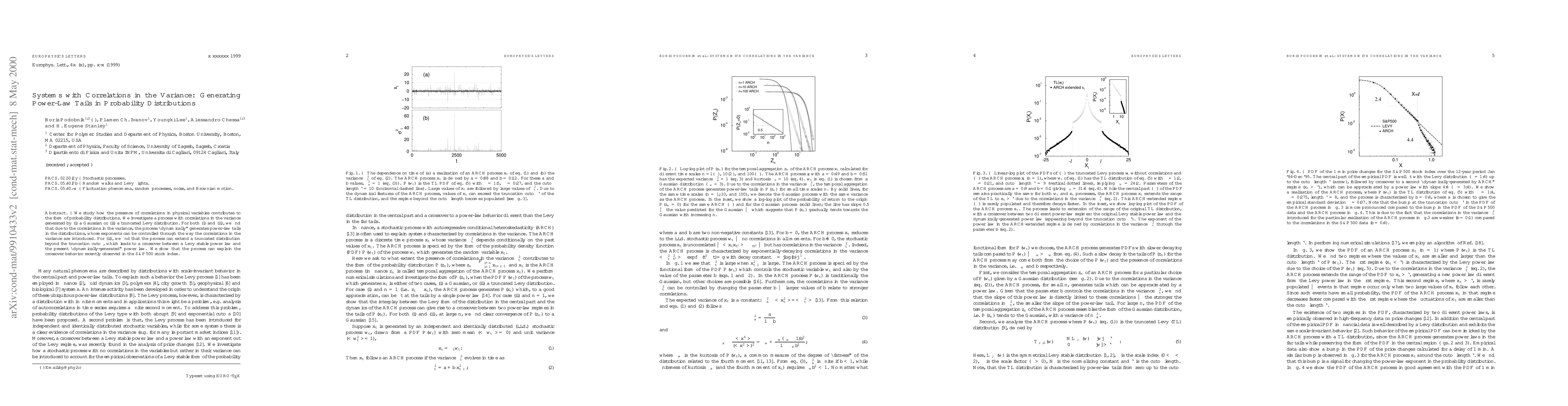

We study how the presence of correlations in physical variables contributes to the form of probability distributions. We investigate a process with correlations in the variance generated by (i) a Gaussian or (ii) a truncated L\'{e}vy distribution. For both (i) and (ii), we find that due to the correlations in the variance, the process ``dynamically'' generates power-law tails in the distributions, whose exponents can be controlled through the way the correlations in the variance are introduced. For (ii), we find that the process can extend a truncated distribution {\it beyond the truncation cutoff}, which leads to a crossover between a L\'{e}vy stable power law and the present ``dynamically-generated'' power law. We show that the process can explain the crossover behavior recently observed in the $S&P500$ stock index.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)