Summary

We examine the performance of six estimators of the power-law cross-correlations -- the detrended cross-correlation analysis, the detrending moving-average cross-correlation analysis, the height cross-correlation analysis, the averaged periodogram estimator, the cross-periodogram estimator and the local cross-Whittle estimator -- under heavy-tailed distributions. The selection of estimators allows to separate these into the time and frequency domain estimators. By varying the characteristic exponent of the $\alpha$-stable distributions which controls the tails behavior, we report several interesting findings. First, the frequency domain estimators are practically unaffected by heavy tails bias-wise. Second, the time domain estimators are upward biased for heavy tails but they have lower estimator variance than the other group for short series. Third, specific estimators are more appropriate depending on distributional properties and length of the analyzed series. In addition, we provide a discussion of implications of these results for empirical applications as well as theoretical explanations.

AI Key Findings

Generated Sep 07, 2025

Methodology

The paper examines six estimators of power-law cross-correlations (detrended cross-correlation analysis, detrending moving-average cross-correlation analysis, height cross-correlation analysis, averaged periodogram estimator, cross-periodogram estimator, and local cross-Whittle estimator) under heavy-tailed distributions, separating them into time and frequency domain estimators.

Key Results

- Frequency domain estimators are practically unaffected by heavy tails bias-wise.

- Time domain estimators are upward biased for heavy tails but have lower variance for short series.

- Specific estimators are more appropriate depending on distributional properties and series length.

Significance

Understanding the behavior of these estimators under heavy tails is crucial for accurate empirical applications in various fields, including finance, geophysics, and hydrology.

Technical Contribution

The paper provides a detailed analysis of the performance of various cross-correlation estimators under heavy-tailed distributions, separating them into time and frequency domain categories.

Novelty

The research distinguishes itself by examining the impact of heavy tails on both time and frequency domain estimators, offering insights into their relative performance and suitability for different distributional properties and series lengths.

Limitations

- The study is limited to six specific estimators; broader generalizations may not apply to all cross-correlation estimation methods.

- The findings are based on simulations using $\alpha$-stable distributions; real-world data may exhibit different heavy-tailed behaviors.

Future Work

- Further investigation into the performance of other cross-correlation estimators under heavy tails.

- Empirical validation of the findings using real-world datasets with heavy tails.

Paper Details

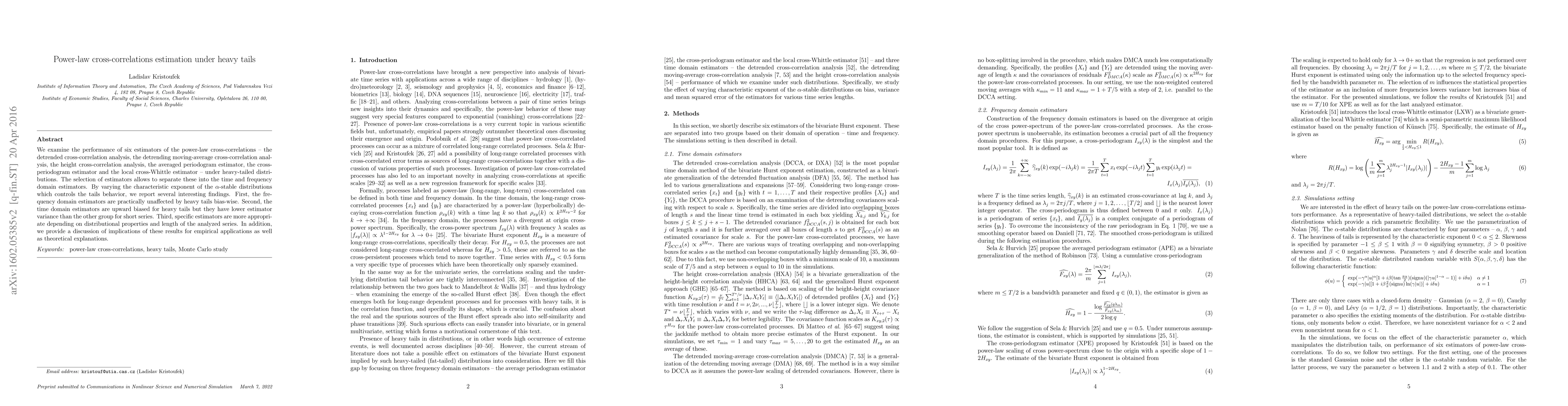

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)