Summary

We introduce a new test for detection of power-law cross-correlations among a pair of time series - the rescaled covariance test. The test is based on a power-law divergence of the covariance of the partial sums of the long-range cross-correlated processes. Utilizing a heteroskedasticity and auto-correlation robust estimator of the long-term covariance, we develop a test with desirable statistical properties which is well able to distinguish between short- and long-range cross-correlations. Such test should be used as a starting point in the analysis of long-range cross-correlations prior to an estimation of bivariate long-term memory parameters. As an application, we show that the relationship between volatility and traded volume, and volatility and returns in the financial markets can be labeled as the one with power-law cross-correlations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

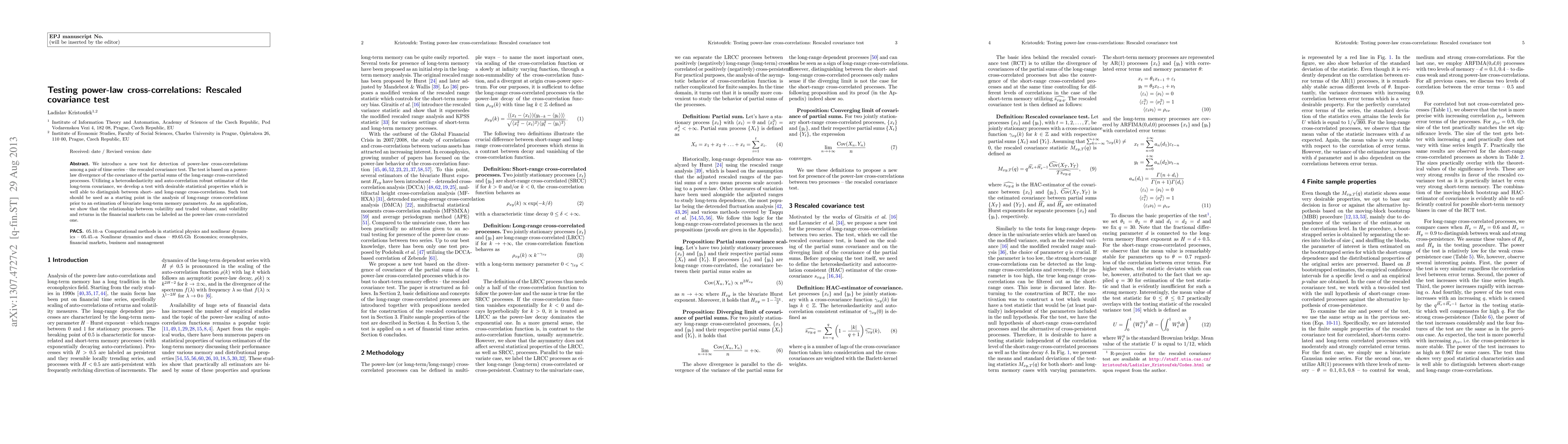

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)