Summary

Podobnik and Stanley recently proposed a novel framework, Detrended Cross-Correlation Analysis, for the analysis of power-law cross-correlation between two time-series, a phenomenon which occurs widely in physical, geophysical, financial and numerous additional applications. While highly promising in these important application domains, to date no rigorous or efficient statistical test has been proposed which uses the information provided by DCCA across time-scales for the presence of this power-law cross-correlation. In this paper we fill this gap by proposing a method based on DCCA for testing the hypothesis of power-law cross-correlation; the method synthesizes the information generated by DCCA across time-scales and returns conservative but practically relevant p-values for the null hypothesis of zero correlation, which may be efficiently calculated in software. Thus our proposals generate confidence estimates for a DCCA analysis in a fully probabilistic fashion.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

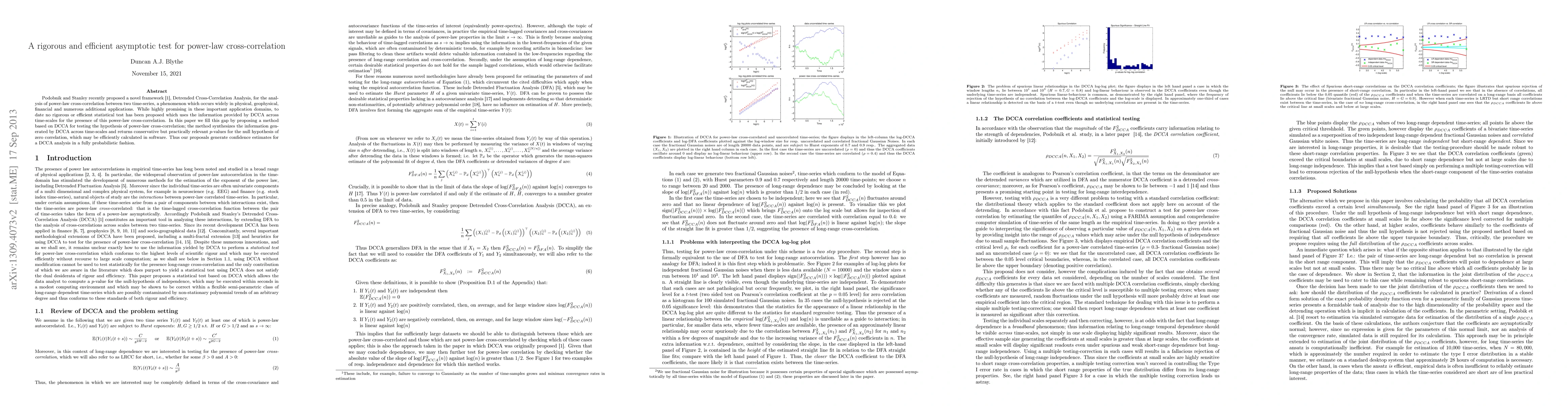

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)