Authors

Summary

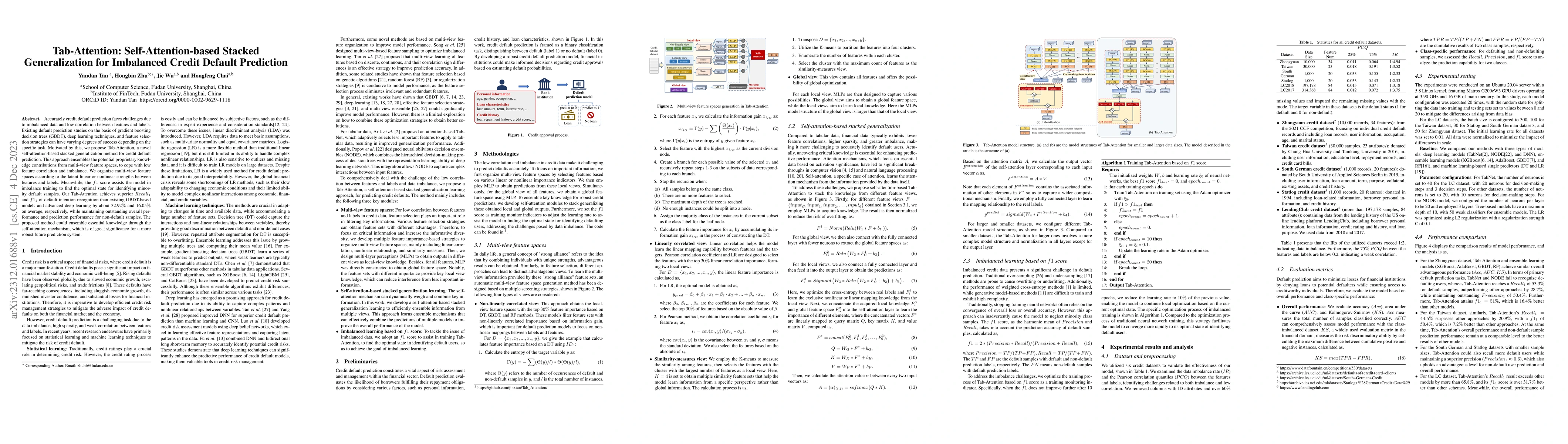

Accurately credit default prediction faces challenges due to imbalanced data and low correlation between features and labels. Existing default prediction studies on the basis of gradient boosting decision trees (GBDT), deep learning techniques, and feature selection strategies can have varying degrees of success depending on the specific task. Motivated by this, we propose Tab-Attention, a novel self-attention-based stacked generalization method for credit default prediction. This approach ensembles the potential proprietary knowledge contributions from multi-view feature spaces, to cope with low feature correlation and imbalance. We organize multi-view feature spaces according to the latent linear or nonlinear strengths between features and labels. Meanwhile, the f1 score assists the model in imbalance training to find the optimal state for identifying minority default samples. Our Tab-Attention achieves superior Recall_1 and f1_1 of default intention recognition than existing GBDT-based models and advanced deep learning by about 32.92% and 16.05% on average, respectively, while maintaining outstanding overall performance and prediction performance for non-default samples. The proposed method could ensemble essential knowledge through the self-attention mechanism, which is of great significance for a more robust future prediction system.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research proposes Tab-Attention, a self-attention-based stacked generalization method for credit default prediction, addressing challenges from imbalanced data and low feature-label correlation using multi-view feature spaces and self-attention mechanism.

Key Results

- Tab-Attention achieves superior Recall_1 and f1_1 of default intention recognition compared to existing GBDT-based models and advanced deep learning by about 32.92% and 16.05% on average, respectively.

- The method maintains outstanding overall performance and prediction performance for non-default samples.

- The self-attention mechanism effectively ensembles essential knowledge, which is significant for robust future prediction systems.

Significance

This research is important as it proposes a novel method to tackle the challenges of imbalanced credit default prediction, improving the identification of default users while maintaining high performance for non-default users.

Technical Contribution

The introduction of Tab-Attention, a self-attention-based stacked generalization method that effectively handles imbalanced credit datasets by leveraging multi-view feature spaces and self-attention mechanisms.

Novelty

Tab-Attention distinguishes itself by combining self-attention with stacked generalization tailored for imbalanced credit datasets, enhancing default prediction accuracy while maintaining strong performance for non-default samples.

Limitations

- The paper does not discuss potential limitations or assumptions of the proposed method.

- No information is provided on the generalizability of the model to other types of imbalanced datasets.

Future Work

- Exploring the application of Tab-Attention on other imbalanced datasets for validation.

- Investigating the scalability of the method for very large datasets with numerous features.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAttention-based Dynamic Multilayer Graph Neural Networks for Loan Default Prediction

Kamesh Korangi, Christophe Mues, Cristián Bravo et al.

TAB: Transformer Attention Bottlenecks enable User Intervention and Debugging in Vision-Language Models

Anh Totti Nguyen, Rosanne Liu, Long Mai et al.

KACDP: A Highly Interpretable Credit Default Prediction Model

Jin Zhao, Kun Liu

Ensemble Methodology:Innovations in Credit Default Prediction Using LightGBM, XGBoost, and LocalEnsemble

Ye Zhang, Xu Yan, Yulu Gong et al.

No citations found for this paper.

Comments (0)