Authors

Summary

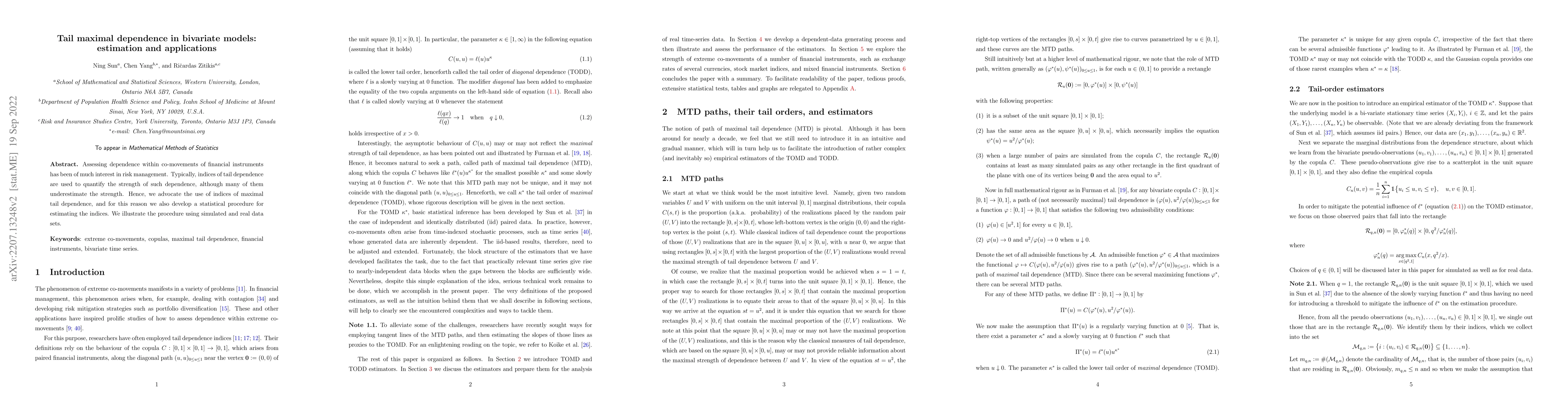

Assessing dependence within co-movements of financial instruments has been of much interest in risk management. Typically, indices of tail dependence are used to quantify the strength of such dependence, although many of the indices underestimate the strength. Hence, we advocate the use of a statistical procedure designed to estimate the maximal strength of dependence that can possibly occur among the co-movements. We illustrate the procedure using simulated and real data-sets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)