Summary

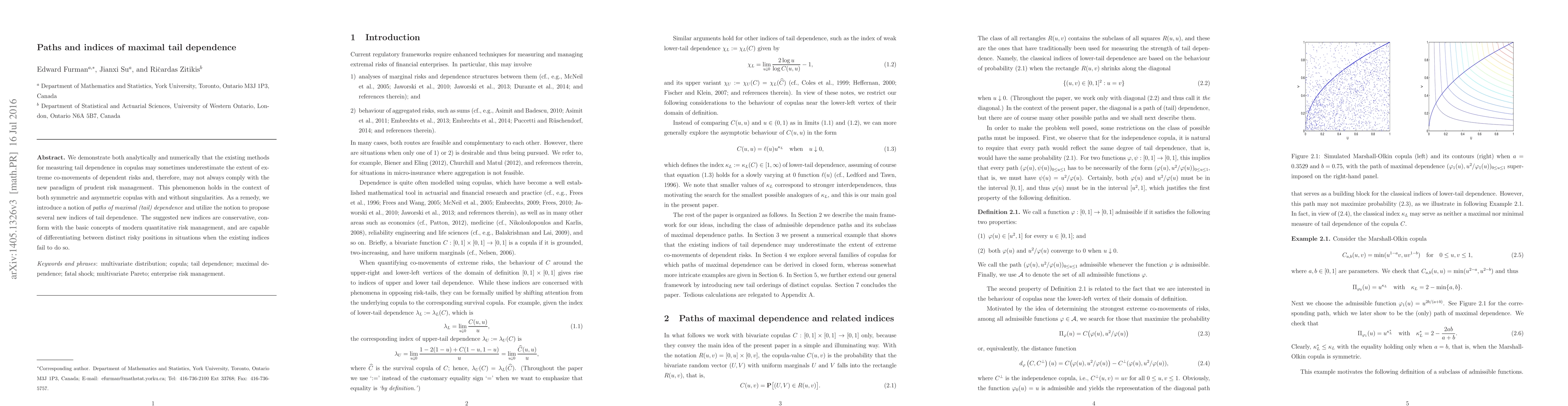

We demonstrate both analytically and numerically that the existing methods for measuring tail dependence in copulas may sometimes underestimate the extent of extreme co-movements of dependent risks and, therefore, may not always comply with the new paradigm of prudent risk management. This phenomenon holds in the context of both symmetric and asymmetric copulas with and without singularities. As a remedy, we introduce a notion of paths of maximal (tail) dependence and utilize it to propose several new indices of tail dependence. The suggested new indices are conservative, conform with the basic concepts of modern quantitative risk management, and are able to distinguish between distinct risky positions in situations when the existing indices fail to do so.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTail maximal dependence in bivariate models: estimation and applications

Chen Yang, Ning Sun, Ričardas Zitikis

Measuring non-exchangeable tail dependence using tail copulas

Takaaki Koike, Marius Hofert, Shogo Kato

Comparing and quantifying tail dependence

Christopher Strothmann, Karl Friedrich Siburg, Gregor Weiß

| Title | Authors | Year | Actions |

|---|

Comments (0)