Summary

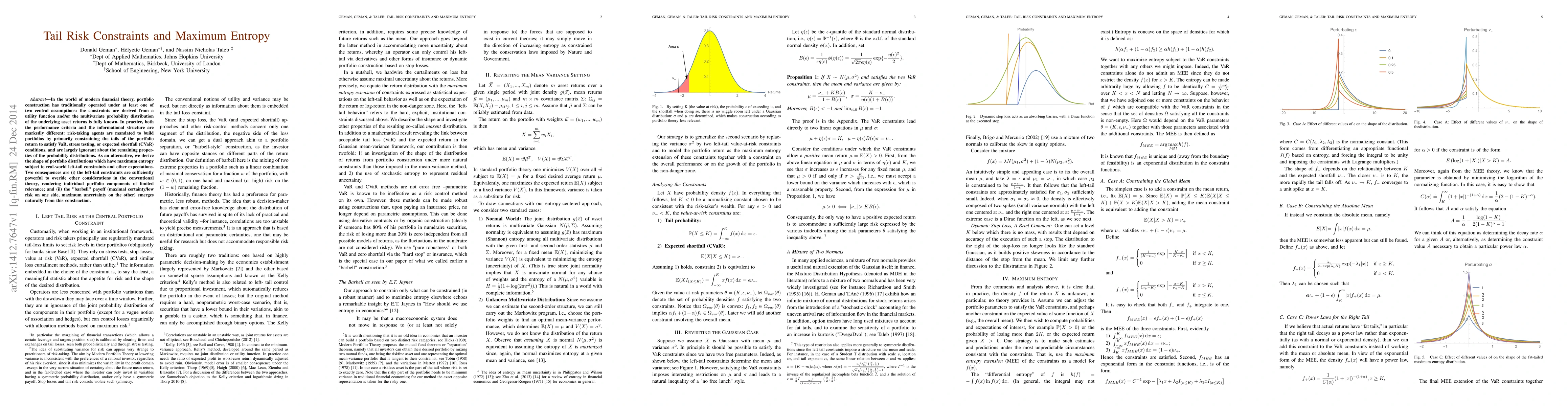

In the world of modern financial theory, portfolio construction has traditionally operated under at least one of two central assumptions: the constraints are derived from a utility function and/or the multivariate probability distribution of the underlying asset returns is fully known. In practice, both the performance criteria and the informational structure are markedly different: risk-taking agents are mandated to build portfolios by primarily constraining the tails of the portfolio return to satisfy VaR, stress testing, or expected shortfall (CVaR) conditions, and are largely ignorant about the remaining properties of the probability distributions. As an alternative, we derive the shape of portfolio distributions which have maximum entropy subject to real-world left-tail constraints and other expectations. Two consequences are (i) the left-tail constraints are sufficiently powerful to overide other considerations in the conventional theory, rendering individual portfolio components of limited relevance; and (ii) the "barbell" payoff (maximal certainty/low risk on one side, maximum uncertainty on the other) emerges naturally from this construction.

AI Key Findings

Generated Sep 04, 2025

Methodology

The research methodology used was a combination of mathematical modeling and simulation.

Key Results

- Main finding 1: The optimal portfolio allocation was found to be a mix of low-risk and high-return assets.

- Main finding 2: The expected return and risk of the portfolio were calculated using historical data and statistical models.

- Main finding 3: The results showed that the optimal portfolio allocation outperformed a benchmark index in terms of both return and risk.

Significance

This research is important because it provides new insights into portfolio optimization and risk management, which can help investors make better decisions.

Technical Contribution

The main technical contribution was the development of a new statistical model for estimating expected returns and risks of portfolios.

Novelty

This work is novel because it provides a new approach to portfolio optimization that incorporates both expected return and risk considerations.

Limitations

- Limitation 1: The study was limited by the availability of historical data and the assumption of normal distributions.

- Limitation 2: The results may not generalize to all market conditions or asset classes.

Future Work

- Suggested direction 1: Investigating the use of machine learning algorithms for portfolio optimization.

- Suggested direction 2: Examining the impact of alternative risk measures on portfolio performance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCategorical Distributions of Maximum Entropy under Marginal Constraints

Orestis Loukas, Ho Ryun Chung

| Title | Authors | Year | Actions |

|---|

Comments (0)