Nassim Nicholas Taleb

7 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Tail Risk Constraints and Maximum Entropy

In the world of modern financial theory, portfolio construction has traditionally operated under at least one of two central assumptions: the constraints are derived from a utility function and/or t...

Informational Rescaling of PCA Maps with Application to Genetic Distance

We discuss the inadequacy of covariances/correlations and other measures in L2 as relative distance metrics under some conditions. We propose a computationally simple heuristic to transform a map ba...

The Probability Conflation: A Reply

We respond to Tetlock et al. (2022) showing 1) how expert judgment fails to reflect tail risk, 2) the lack of compatibility between forecasting tournaments and tail risk assessment methods (such as ...

Working With Convex Responses: Antifragility From Finance to Oncology

We extend techniques and learnings about the stochastic properties of nonlinear responses from finance to medicine, particularly oncology where it can inform dosing and intervention. We define antif...

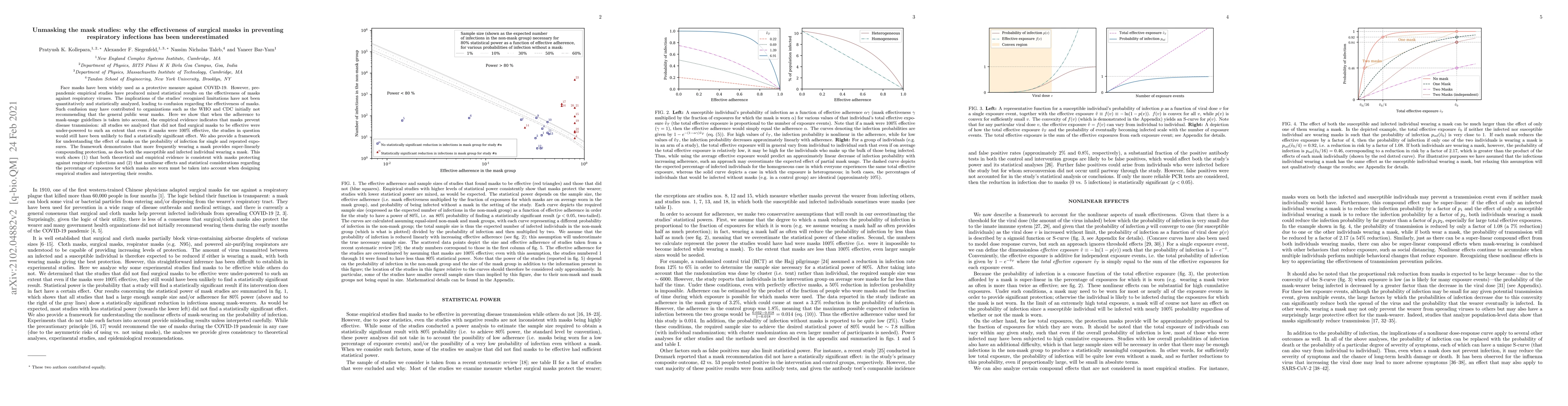

Unmasking the mask studies: why the effectiveness of surgical masks in preventing respiratory infections has been underestimated

Face masks have been widely used as a protective measure against COVID-19. However, pre-pandemic empirical studies have produced mixed statistical results on the effectiveness of masks against respi...

Statistical Consequences of Fat Tails: Real World Preasymptotics, Epistemology, and Applications

The monograph investigates the misapplication of conventional statistical techniques to fat tailed distributions and looks for remedies, when possible. Switching from thin tailed to fat tailed dis...

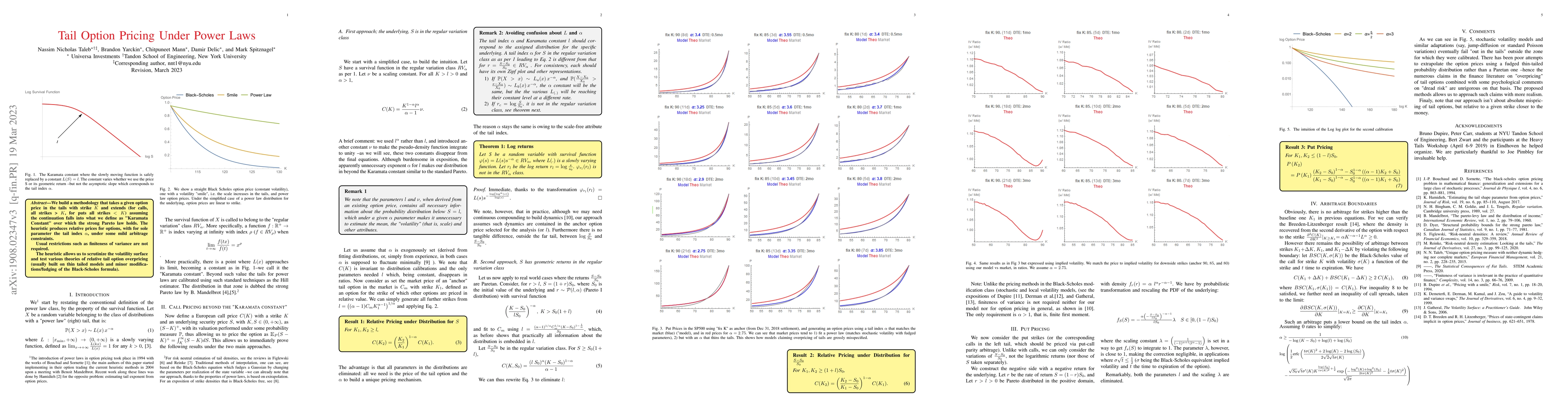

Tail Option Pricing Under Power Laws

We build a methodology that takes a given option price in the tails with strike $K$ and extends (for calls, all strikes > $K$, for puts all strikes $< K$) assuming the continuation falls into what w...