Authors

Summary

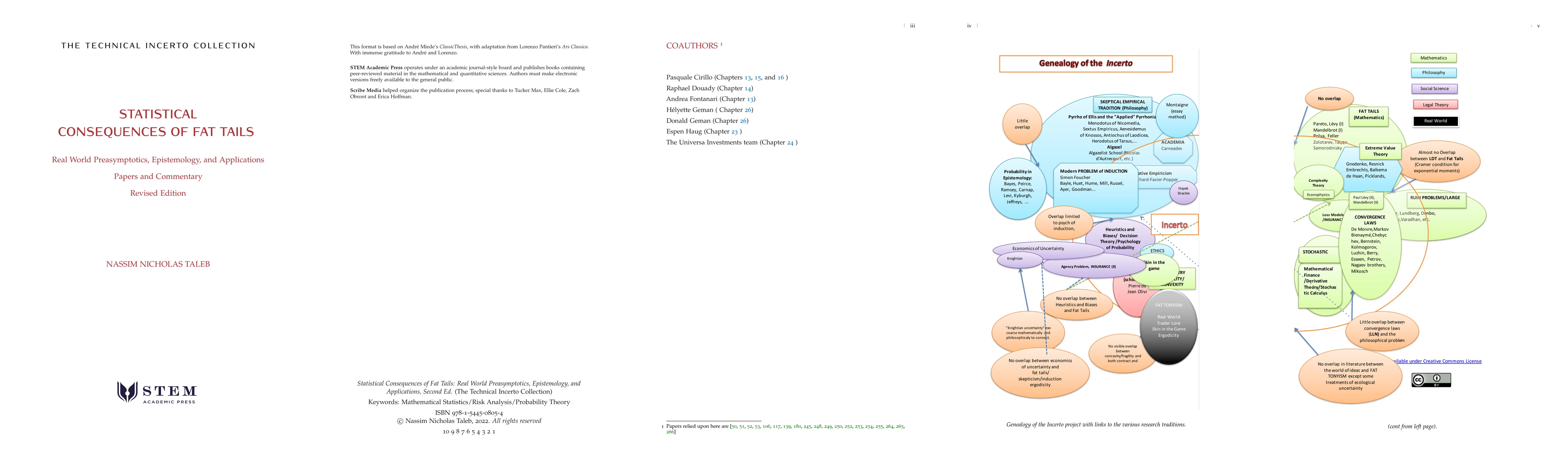

The monograph investigates the misapplication of conventional statistical techniques to fat tailed distributions and looks for remedies, when possible. Switching from thin tailed to fat tailed distributions requires more than "changing the color of the dress". Traditional asymptotics deal mainly with either n=1 or $n=\infty$, and the real world is in between, under of the "laws of the medium numbers" --which vary widely across specific distributions. Both the law of large numbers and the generalized central limit mechanisms operate in highly idiosyncratic ways outside the standard Gaussian or Levy-Stable basins of convergence. A few examples: + The sample mean is rarely in line with the population mean, with effect on "naive empiricism", but can be sometimes be estimated via parametric methods. + The "empirical distribution" is rarely empirical. + Parameter uncertainty has compounding effects on statistical metrics. + Dimension reduction (principal components) fails. + Inequality estimators (GINI or quantile contributions) are not additive and produce wrong results. + Many "biases" found in psychology become entirely rational under more sophisticated probability distributions + Most of the failures of financial economics, econometrics, and behavioral economics can be attributed to using the wrong distributions. This book, the first volume of the Technical Incerto, weaves a narrative around published journal articles.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research investigates the misapplication of conventional statistical techniques to fat-tailed distributions, exploring remedies when possible. It examines how switching from thin-tailed to fat-tailed distributions necessitates more than just a change in statistical methods, considering the 'laws of the medium numbers' that vary widely across specific distributions.

Key Results

- The sample mean often deviates from the population mean, impacting naive empiricism but sometimes being estimable via parametric methods.

- The 'empirical distribution' is rarely genuinely empirical.

- Parameter uncertainty compounds effects on statistical metrics.

- Dimension reduction (principal components) fails under fat-tailed distributions.

- Inequality estimators (GINI or quantile contributions) are not additive and produce incorrect results.

- Many 'biases' in psychology become rational under more sophisticated probability distributions.

- Most failures in financial economics, econometrics, and behavioral economics can be attributed to using the wrong distributions.

Significance

This research is significant as it highlights the critical misapplication of traditional statistical methods to real-world data that often exhibit fat-tailed distributions, leading to erroneous conclusions and ineffective policies in various fields including finance, economics, and behavioral studies.

Technical Contribution

The paper contributes by detailing the idiosyncratic behavior of statistical mechanisms like the law of large numbers and the central limit theorem outside standard Gaussian or Levy-Stable convergence basins for fat-tailed distributions.

Novelty

The novelty lies in its comprehensive examination of how conventional statistical assumptions break down under fat-tailed distributions, offering insights into the real-world preasymptotics that are often overlooked in traditional statistical theory.

Limitations

- The study primarily focuses on theoretical analysis and does not extensively provide empirical evidence or practical applications.

- The scope is limited to statistical techniques and does not explore other methodologies used in data analysis.

Future Work

- Further empirical studies to validate the theoretical findings across diverse datasets and fields.

- Development of new statistical tools and methods specifically designed for fat-tailed distributions.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)