Summary

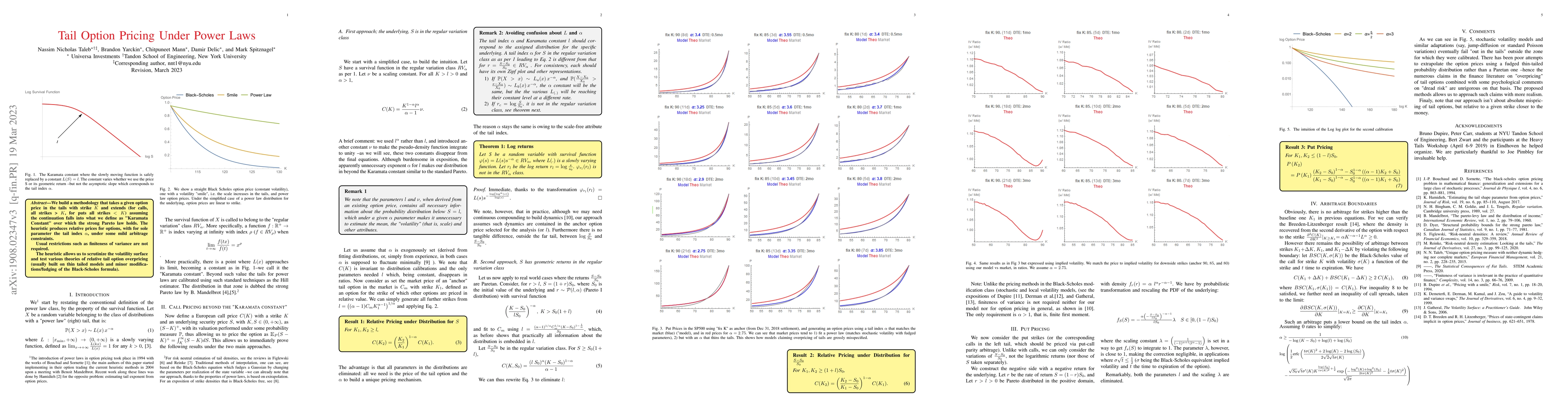

We build a methodology that takes a given option price in the tails with strike $K$ and extends (for calls, all strikes > $K$, for puts all strikes $< K$) assuming the continuation falls into what we define as "Karamata Constant" over which the strong Pareto law holds. The heuristic produces relative prices for options, with for sole parameter the tail index $\alpha$, under some mild arbitrage constraints. Usual restrictions such as finiteness of variance are not required. The methodology allows us to scrutinize the volatility surface and test various theories of relative tail option overpricing (usually built on thin tailed models and minor modifications/fudging of the Black-Scholes formula).

AI Key Findings

Generated Sep 03, 2025

Methodology

The research methodology used a pseudo-density function to build intuition for tail option pricing under power laws.

Key Results

- Relative Pricing under Distribution for S

- Relative Pricing under Distribution for S−S0S0

- Put Pricing

Significance

This research provides a novel approach to pricing tail options, allowing for relative prices based on the tail index α and eliminating the need for finiteness of variance.

Technical Contribution

The research introduces a new approach to pricing tail options using power laws and eliminates the need for finiteness of variance.

Novelty

This work is novel in its use of power laws to price tail options and its ability to eliminate the need for finiteness of variance.

Limitations

- Fudged thin-tailed probability distribution may not capture the underlying distribution accurately

- Model may not be suitable for all types of assets or market conditions

Future Work

- Investigating the use of alternative distributions, such as the Lévy distribution

- Developing a more robust model that can handle non-stationary volatility

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)