Summary

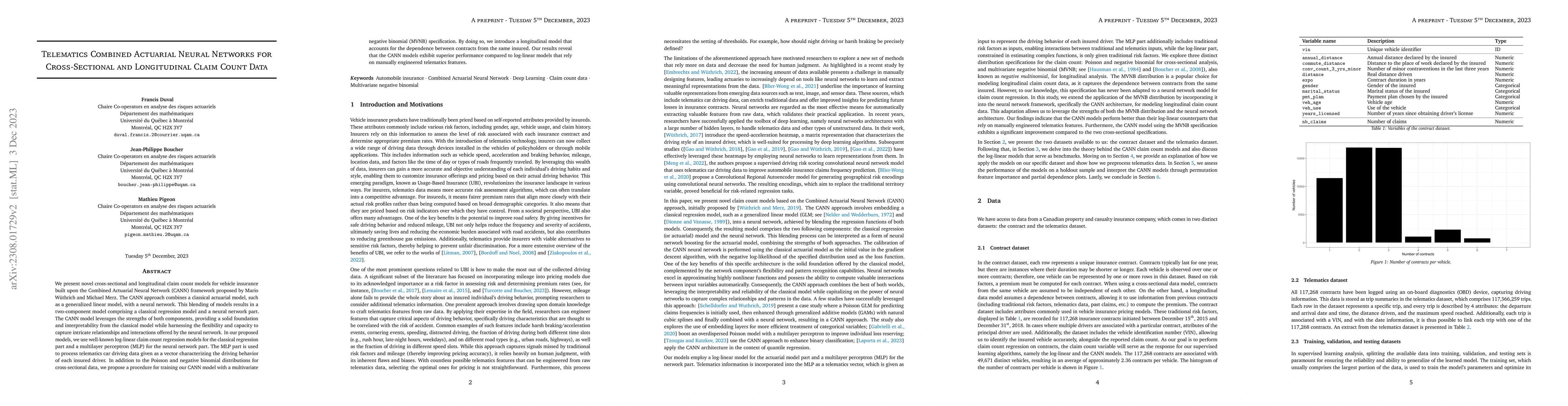

We present novel cross-sectional and longitudinal claim count models for vehicle insurance built upon the Combined Actuarial Neural Network (CANN) framework proposed by Mario W\"uthrich and Michael Merz. The CANN approach combines a classical actuarial model, such as a generalized linear model, with a neural network. This blending of models results in a two-component model comprising a classical regression model and a neural network part. The CANN model leverages the strengths of both components, providing a solid foundation and interpretability from the classical model while harnessing the flexibility and capacity to capture intricate relationships and interactions offered by the neural network. In our proposed models, we use well-known log-linear claim count regression models for the classical regression part and a multilayer perceptron (MLP) for the neural network part. The MLP part is used to process telematics car driving data given as a vector characterizing the driving behavior of each insured driver. In addition to the Poisson and negative binomial distributions for cross-sectional data, we propose a procedure for training our CANN model with a multivariate negative binomial (MVNB) specification. By doing so, we introduce a longitudinal model that accounts for the dependence between contracts from the same insured. Our results reveal that the CANN models exhibit superior performance compared to log-linear models that rely on manually engineered telematics features.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research presents novel cross-sectional and longitudinal claim count models for vehicle insurance using the Combined Actuarial Neural Network (CANN) framework, combining classical actuarial models with neural networks to leverage their respective strengths.

Key Results

- CANN models outperform log-linear models that rely on manually engineered telematics features.

- A multivariate negative binomial (MVNB) specification is proposed for training the CANN model, accounting for dependence between contracts from the same insured.

- The CANN architecture effectively captures complex relationships and interactions from telematics driving data.

Significance

This study advances the accurate modeling of claim counts in usage-based insurance, enhancing predictive model performance by effectively utilizing telematics data.

Technical Contribution

The paper introduces an adapted CANN architecture to accommodate the MVNB distribution specification, effectively capturing time-dependence between insurance contracts.

Novelty

The research distinguishes itself by combining actuarial knowledge with neural networks, specifically addressing the complexities of telematics data in vehicle insurance claim count modeling.

Limitations

- The study is constrained by time and computational limitations, which affected the fine-tuning of CANN models.

- Alternative longitudinal specifications, such as the beta-binomial distribution, were not explored.

Future Work

- Investigate the impact of using richer telematics data, such as second-by-second data or additional information like harsh acceleration/braking and distracted driving.

- Explore more advanced tuning methods beyond the grid search approach used in this study.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDiagnostic Tests Before Modeling Longitudinal Actuarial Data

Liang Peng, Tsz Chai Fung, Linyi Qian et al.

A deep learning pipeline for cross-sectional and longitudinal multiview data integration

Sarthak Jain, Sandra E. Safo

| Title | Authors | Year | Actions |

|---|

Comments (0)