Authors

Summary

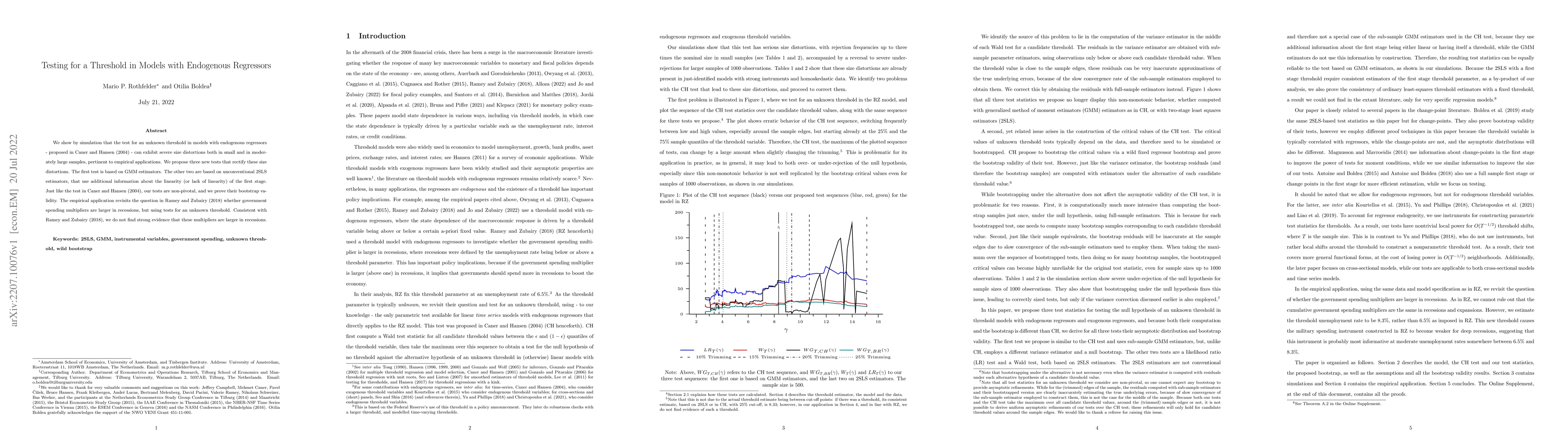

We show by simulation that the test for an unknown threshold in models with endogenous regressors - proposed in Caner and Hansen (2004) - can exhibit severe size distortions both in small and in moderately large samples, pertinent to empirical applications. We propose three new tests that rectify these size distortions. The first test is based on GMM estimators. The other two are based on unconventional 2SLS estimators, that use additional information about the linearity (or lack of linearity) of the first stage. Just like the test in Caner and Hansen (2004), our tests are non-pivotal, and we prove their bootstrap validity. The empirical application revisits the question in Ramey and Zubairy (2018) whether government spending multipliers are larger in recessions, but using tests for an unknown threshold. Consistent with Ramey and Zubairy (2018), we do not find strong evidence that these multipliers are larger in recessions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLatent group structure in linear panel data models with endogenous regressors

Junho Choi, Ryo Okui

Partial Identification in Nonseparable Binary Response Models with Endogenous Regressors

Jiaying Gu, Thomas M. Russell

| Title | Authors | Year | Actions |

|---|

Comments (0)