Authors

Summary

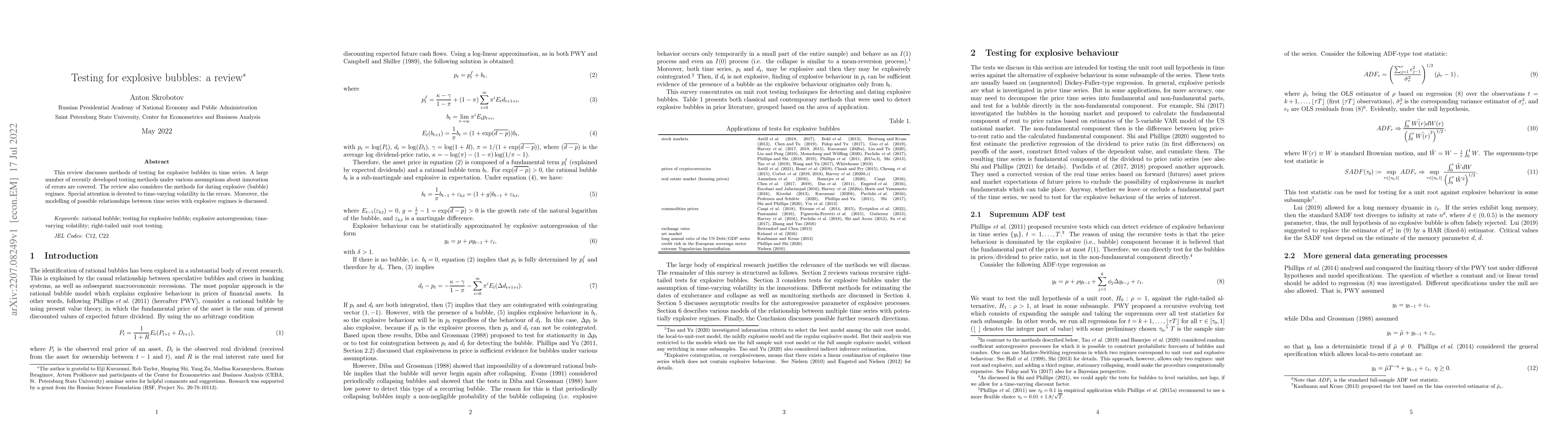

This review discusses methods of testing for explosive bubbles in time series. A large number of recently developed testing methods under various assumptions about innovation of errors are covered. The review also considers the methods for dating explosive (bubble) regimes. Special attention is devoted to time-varying volatility in the errors. Moreover, the modelling of possible relationships between time series with explosive regimes is discussed.

AI Key Findings

Generated Sep 04, 2025

Methodology

This research reviews the development of testing for explosive bubbles, highlighting recent methods that account for various features such as weak dependence, non-stationary conditional and unconditional volatility, and long memory.

Key Results

- Main finding 1: Many empirical applications require researchers to first test for an explosive bubble using very general assumptions.

- Main finding 2: If a bubble is detected, subsequent analysis should be conducted under similar assumptions to ensure consistency.

- Main finding 3: Further research is needed to address issues such as accommodating long memory dynamics in data generating processes and incorporating heteroskedasticity.

Significance

This review contributes to the understanding of explosive bubbles by highlighting recent methods that can be applied to empirical applications, ultimately informing policymakers and financial practitioners.

Technical Contribution

This review provides a comprehensive overview of recent methods for testing explosive bubbles, highlighting their technical and theoretical contributions to the field.

Novelty

What makes this work novel or different from existing research is its focus on addressing various features such as weak dependence, non-stationary conditional and unconditional volatility, and long memory in testing for explosive bubbles.

Limitations

- Limitation 1: Current methods may not adequately account for long memory dynamics in data generating processes.

- Limitation 2: Incorporating heteroskedasticity into testing for explosive bubbles is an area that requires further research.

Future Work

- Suggested direction 1: Developing methods to accommodate long memory dynamics in data generating processes.

- Suggested direction 2: Investigating the incorporation of heteroskedasticity into testing for explosive bubbles.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe quest for explosive bubbles in the Indonesian Rupiah/US exchange rate: Does the uncertainty trinity matter?

Abdul Khaliq, Syafruddin Karimi, Werry Darta Taifur et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)