Summary

Testing for regime switching when the regime switching probabilities are specified either as constants (`mixture models') or are governed by a finite-state Markov chain (`Markov switching models') are long-standing problems that have also attracted recent interest. This paper considers testing for regime switching when the regime switching probabilities are time-varying and depend on observed data (`observation-dependent regime switching'). Specifically, we consider the likelihood ratio test for observation-dependent regime switching in mixture autoregressive models. The testing problem is highly nonstandard, involving unidentified nuisance parameters under the null, parameters on the boundary, singular information matrices, and higher-order approximations of the log-likelihood. We derive the asymptotic null distribution of the likelihood ratio test statistic in a general mixture autoregressive setting using high-level conditions that allow for various forms of dependence of the regime switching probabilities on past observations, and we illustrate the theory using two particular mixture autoregressive models. The likelihood ratio test has a nonstandard asymptotic distribution that can easily be simulated, and Monte Carlo studies show the test to have satisfactory finite sample size and power properties.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

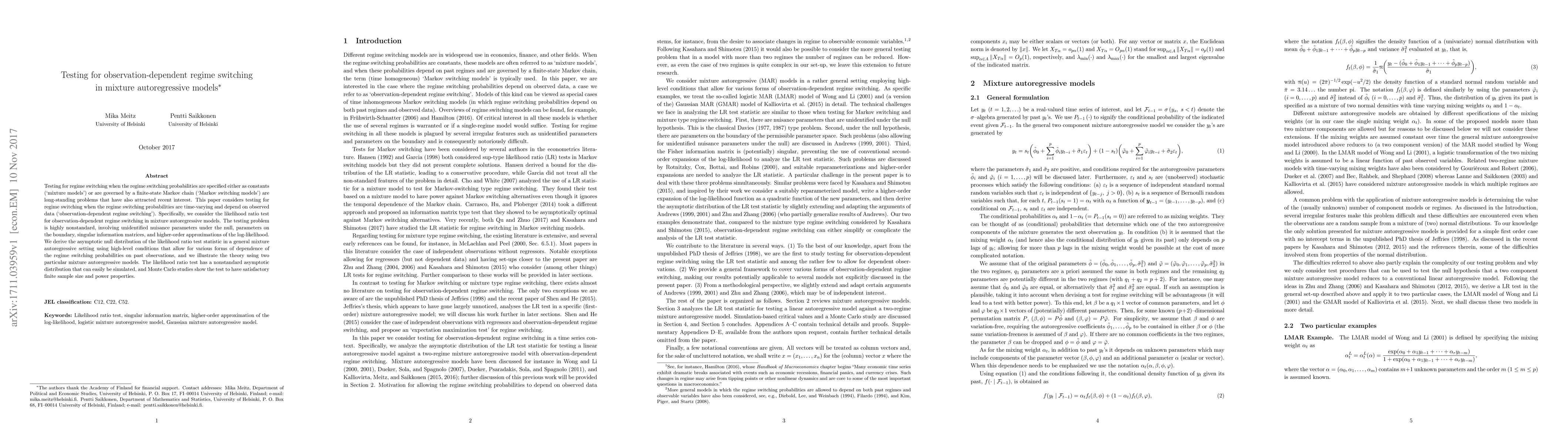

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)