Summary

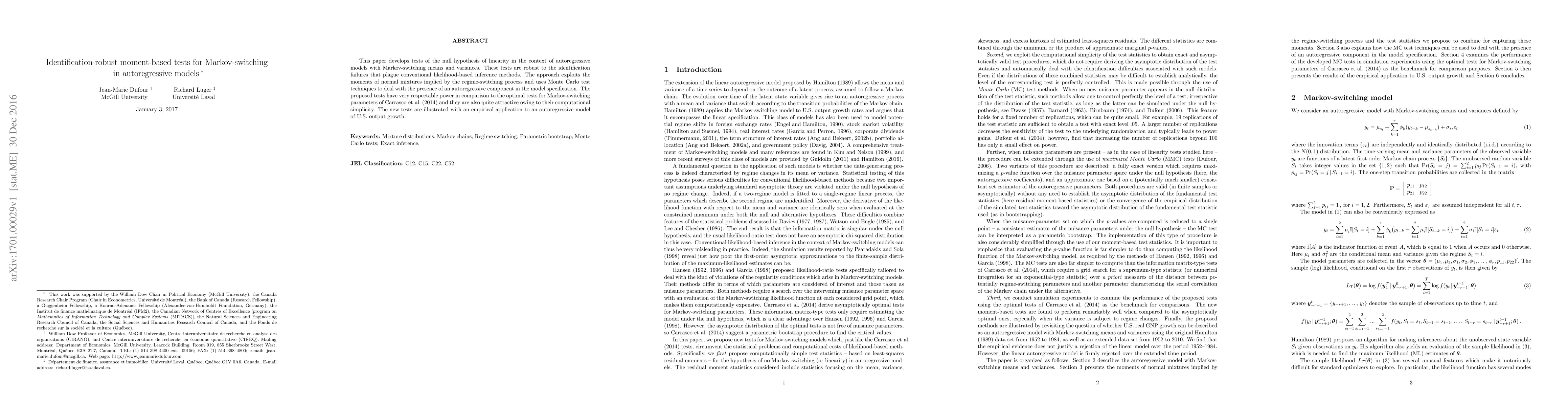

This paper develops tests of the null hypothesis of linearity in the context of autoregressive models with Markov-switching means and variances. These tests are robust to the identification failures that plague conventional likelihood-based inference methods. The approach exploits the moments of normal mixtures implied by the regime-switching process and uses Monte Carlo test techniques to deal with the presence of an autoregressive component in the model specification. The proposed tests have very respectable power in comparison to the optimal tests for Markov-switching parameters of Carrasco, Hu and Ploberger (2014} and they are also quite attractive owing to their computational simplicity. The new tests are illustrated with an empirical application to an autoregressive model of U.S. output growth.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)