Summary

Stock price prediction can be made more efficient by considering the price fluctuations and understanding the sentiments of people. A limited number of models understand financial jargon or have labelled datasets concerning stock price change. To overcome this challenge, we introduced FinALBERT, an ALBERT based model trained to handle financial domain text classification tasks by labelling Stocktwits text data based on stock price change. We collected Stocktwits data for over ten years for 25 different companies, including the major five FAANG (Facebook, Amazon, Apple, Netflix, Google). These datasets were labelled with three labelling techniques based on stock price changes. Our proposed model FinALBERT is fine-tuned with these labels to achieve optimal results. We experimented with the labelled dataset by training it on traditional machine learning, BERT, and FinBERT models, which helped us understand how these labels behaved with different model architectures. Our labelling method competitive advantage is that it can help analyse the historical data effectively, and the mathematical function can be easily customised to predict stock movement.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

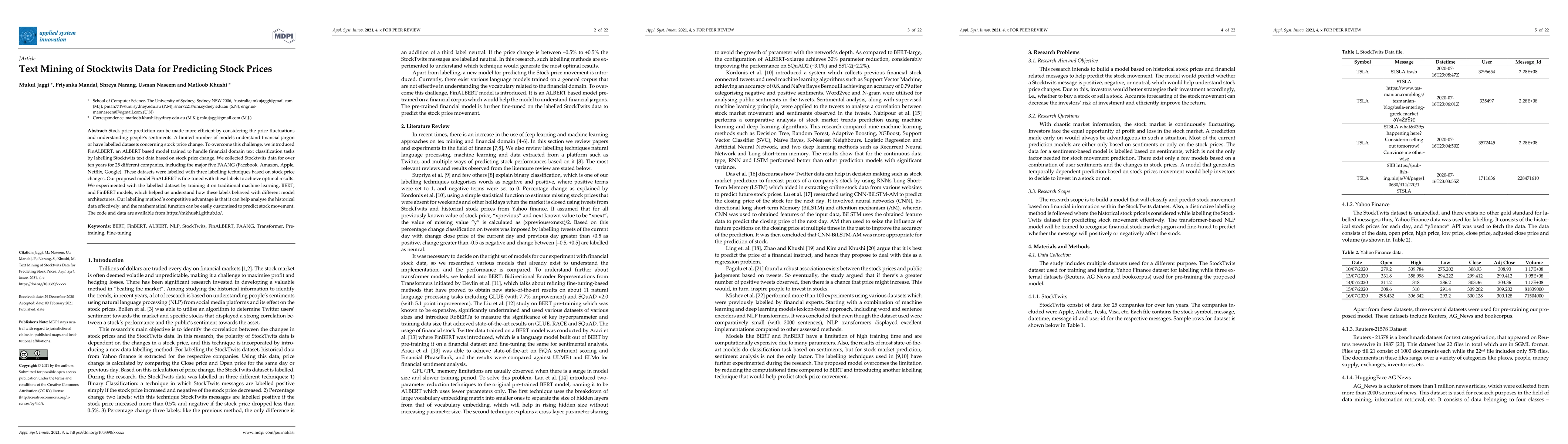

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredicting Stock Prices with FinBERT-LSTM: Integrating News Sentiment Analysis

Yihao Zhong, Zhuoyue Wang, Wenjun Gu et al.

A Comparative Predicting Stock Prices using Heston and Geometric Brownian Motion Models

H. T. Shehzad, M. A. Anwar, M. Razzaq

Predicting stock prices with ChatGPT-annotated Reddit sentiment

Jan Kocoń, Mateusz Kmak, Kamil Chmurzyński et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)