Summary

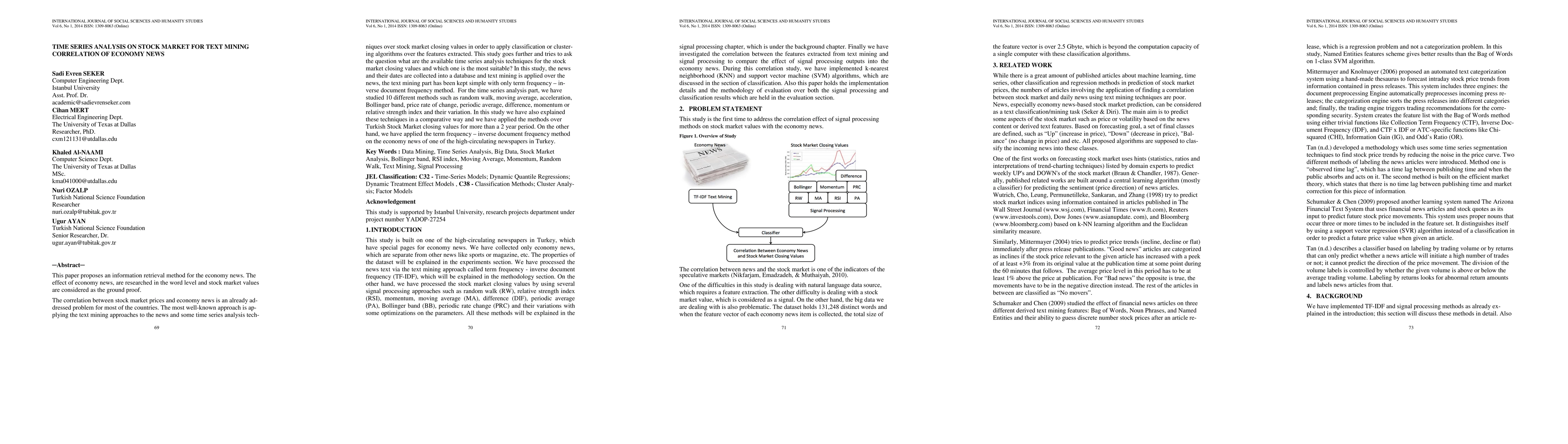

This paper proposes an information retrieval method for the economy news. The effect of economy news, are researched in the word level and stock market values are considered as the ground proof. The correlation between stock market prices and economy news is an already addressed problem for most of the countries. The most well-known approach is applying the text mining approaches to the news and some time series analysis techniques over stock market closing values in order to apply classification or clustering algorithms over the features extracted. This study goes further and tries to ask the question what are the available time series analysis techniques for the stock market closing values and which one is the most suitable? In this study, the news and their dates are collected into a database and text mining is applied over the news, the text mining part has been kept simple with only term frequency-inverse document frequency method. For the time series analysis part, we have studied 10 different methods such as random walk, moving average, acceleration, Bollinger band, price rate of change, periodic average, difference, momentum or relative strength index and their variation. In this study we have also explained these techniques in a comparative way and we have applied the methods over Turkish Stock Market closing values for more than a 2 year period. On the other hand, we have applied the term frequency-inverse document frequency method on the economy news of one of the high-circulating newspapers in Turkey.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCross-Lingual News Event Correlation for Stock Market Trend Prediction

Seemab Latif, Rabia Latif, Sahar Arshad et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)