Summary

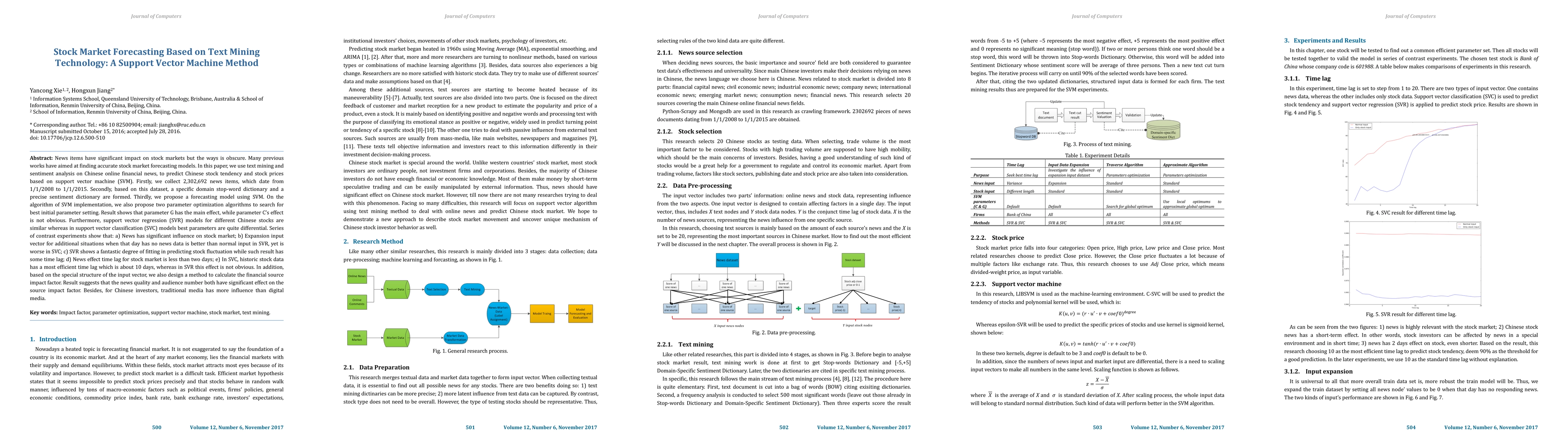

News items have a significant impact on stock markets but the ways are obscure. Many previous works have aimed at finding accurate stock market forecasting models. In this paper, we use text mining and sentiment analysis on Chinese online financial news, to predict Chinese stock tendency and stock prices based on support vector machine (SVM). Firstly, we collect 2,302,692 news items, which date from 1/1/2008 to 1/1/2015. Secondly, based on this dataset, a specific domain stop-word dictionary and a precise sentiment dictionary are formed. Thirdly, we propose a forecasting model using SVM. On the algorithm of SVM implementation, we also propose two-parameter optimization algorithms to search for the best initial parameter setting. The result shows that parameter G has the main effect, while parameter C's effect is not obvious. Furthermore, support vector regression (SVR) models for different Chinese stocks are similar whereas in support vector classification (SVC) models best parameters are quite differential. Series of contrast experiments show that: a) News has significant influence on stock market; b) Expansion input vector for additional situations when that day has no news data is better than normal input in SVR, yet is worse in SVC; c) SVR shows a fantastic degree of fitting in predicting stock fluctuation while such result has some time lag; d) News effect time lag for stock market is less than two days; e) In SVC, historic stock data has a most efficient time lag which is about 10 days, whereas in SVR this effect is not obvious. Besides, based on the special structure of the input vector, we also design a method to calculate the financial source impact factor. Result suggests that the news quality and audience number both have a significant effect on the source impact factor. Besides, for Chinese investors, traditional media has more influence than digital media.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTM-vector: A Novel Forecasting Approach for Market stock movement with a Rich Representation of Twitter and Market data

Ali Karkehabadi, Ali Mohammadi, Ramin Mousa et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)