Authors

Summary

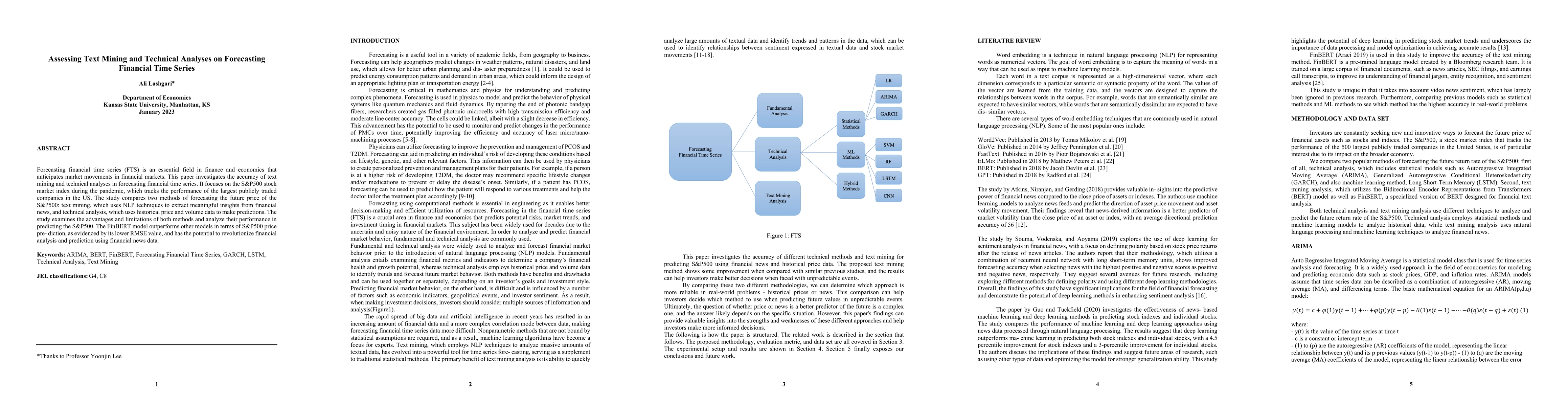

Forecasting financial time series (FTS) is an essential field in finance and economics that anticipates market movements in financial markets. This paper investigates the accuracy of text mining and technical analyses in forecasting financial time series. It focuses on the S&P500 stock market index during the pandemic, which tracks the performance of the largest publicly traded companies in the US. The study compares two methods of forecasting the future price of the S&P500: text mining, which uses NLP techniques to extract meaningful insights from financial news, and technical analysis, which uses historical price and volume data to make predictions. The study examines the advantages and limitations of both methods and analyze their performance in predicting the S&P500. The FinBERT model outperforms other models in terms of S&P500 price prediction, as evidenced by its lower RMSE value, and has the potential to revolutionize financial analysis and prediction using financial news data. Keywords: ARIMA, BERT, FinBERT, Forecasting Financial Time Series, GARCH, LSTM, Technical Analysis, Text Mining JEL classifications: G4, C8

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModality-aware Transformer for Financial Time series Forecasting

Xuan-Hong Dang, Yousaf Shah, Petros Zerfos et al.

Large Language Models for Financial Aid in Financial Time-series Forecasting

Md Khairul Islam, Ayush Karmacharya, Judy Fox et al.

Feature Selection with Annealing for Forecasting Financial Time Series

Adrian Barbu, Hakan Pabuccu

| Title | Authors | Year | Actions |

|---|

Comments (0)