Summary

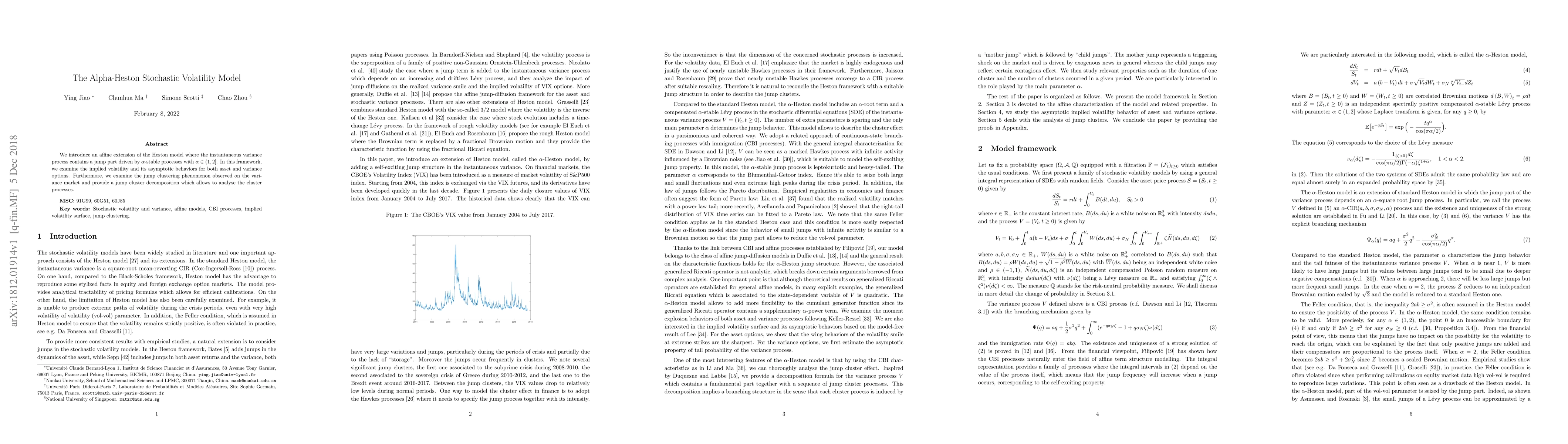

We introduce an affine extension of the Heston model where the instantaneous variance process contains a jump part driven by $\alpha$-stable processes with $\alpha\in(1,2]$. In this framework, we examine the implied volatility and its asymptotic behaviors for both asset and variance options. Furthermore, we examine the jump clustering phenomenon observed on the variance market and provide a jump cluster decomposition which allows to analyse the cluster processes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe rough Hawkes Heston stochastic volatility model

Alessandro Bondi, Sergio Pulido, Simone Scotti

Combined Mutiplicative-Heston Model for Stochastic Volatility

M. Dashti Moghaddam, R. A. Serota

| Title | Authors | Year | Actions |

|---|

Comments (0)