Authors

Summary

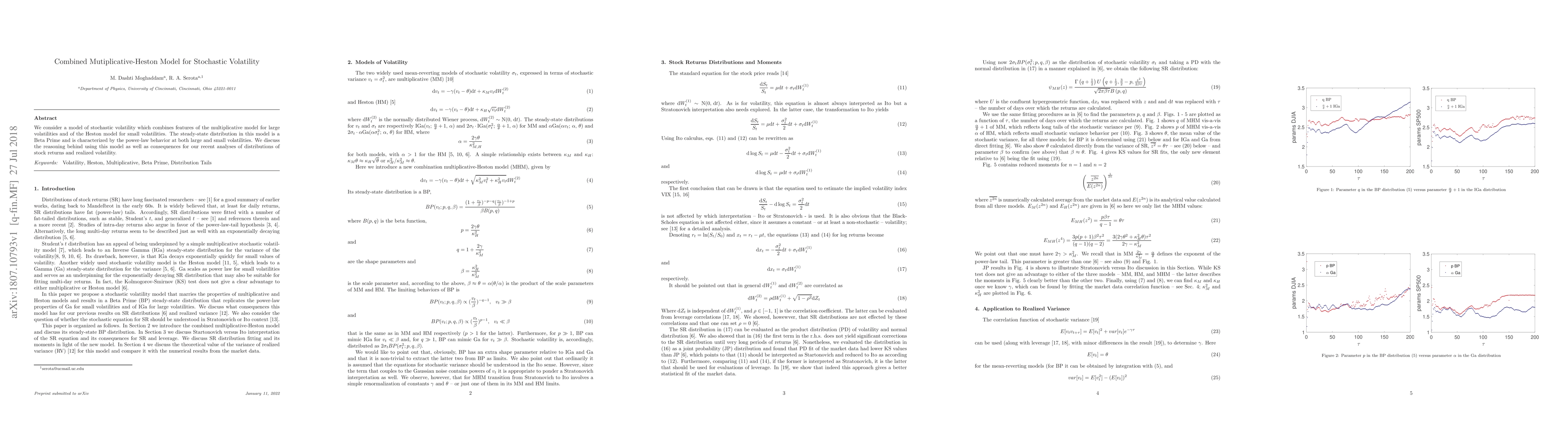

We consider a model of stochastic volatility which combines features of the multiplicative model for large volatilities and of the Heston model for small volatilities. The steady-state distribution in this model is a Beta Prime and is characterized by the power-law behavior at both large and small volatilities. We discuss the reasoning behind using this model as well as consequences for our recent analyses of distributions of stock returns and realized volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe rough Hawkes Heston stochastic volatility model

Alessandro Bondi, Sergio Pulido, Simone Scotti

| Title | Authors | Year | Actions |

|---|

Comments (0)