Summary

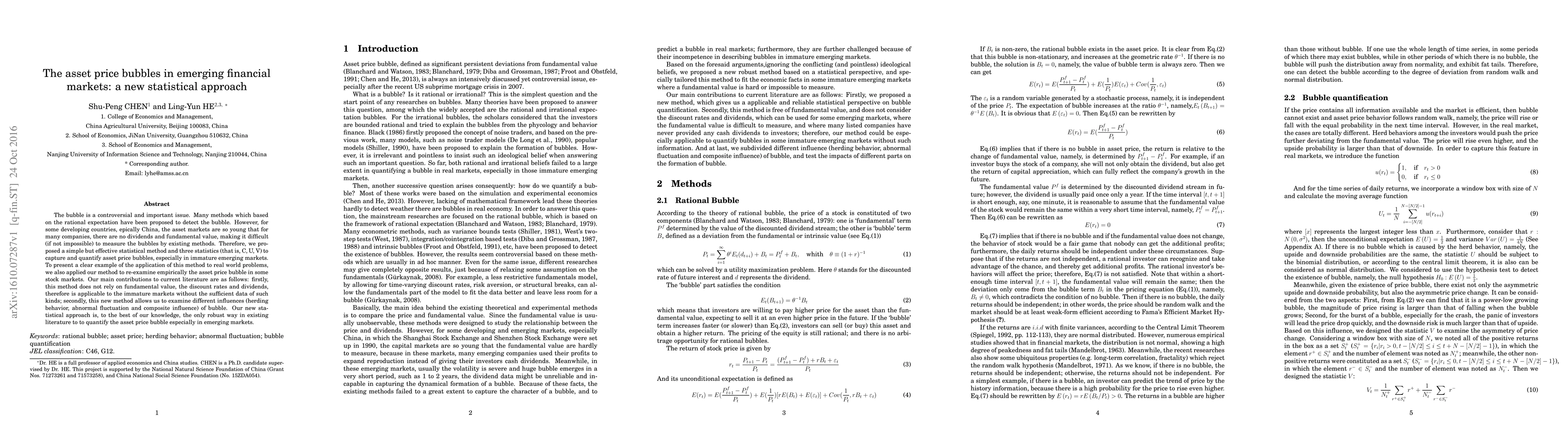

The bubble is a controversial and important issue. Many methods which based on the rational expectation have been proposed to detect the bubble. However, for some developing countries, epically China, the asset markets are so young that for many companies, there are no dividends and fundamental value, making it difficult (if not impossible) to measure the bubbles by existing methods. Therefore, we proposed a simple but effective statistical method and three statistics (that is, C, U, V) to capture and quantify asset price bubbles, especially in immature emerging markets. To present a clear example of the application of this method to real world problems, we also applied our method to re-examine empirically the asset price bubble in some stock markets. Our main contributions to current literature are as follows: firstly, this method does not rely on fundamental value, the discount rates and dividends, therefore is applicable to the immature markets without the sufficient data of such kinds, secondly, this new method allows us to examine different influences (herding behavior, abnormal fluctuation and composite influence) of bubble. Our new statistical approach is, to the best of our knowledge, the only robust way in existing literature to to quantify the asset price bubble especially in emerging markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWhat are Asset Price Bubbles? A Survey on Definitions of Financial Bubbles

Michael Heinrich Baumann, Anja Janischewski

Detecting asset price bubbles using deep learning

Lukas Gonon, Francesca Biagini, Andrea Mazzon et al.

No citations found for this paper.

Comments (0)