Authors

Summary

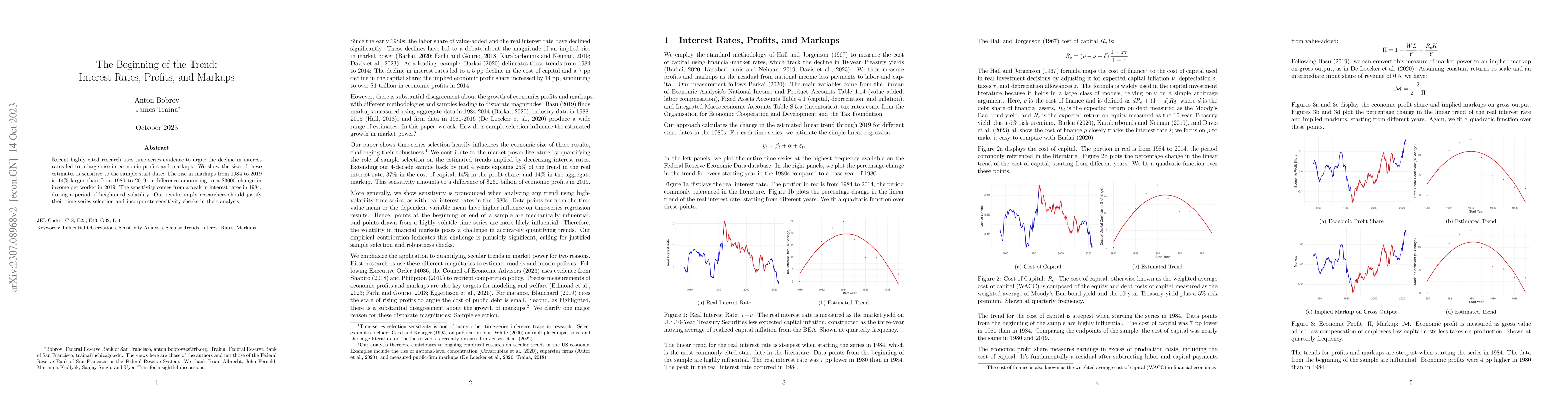

Recent highly cited research uses time-series evidence to argue the decline in interest rates led to a large rise in economic profits and markups. We show the size of these estimates is sensitive to the sample start date: The rise in markups from 1984 to 2019 is 14% larger than from 1980 to 2019, a difference amounting to a $3000 change in income per worker in 2019. The sensitivity comes from a peak in interest rates in 1984, during a period of heightened volatility. Our results imply researchers should justify their time-series selection and incorporate sensitivity checks in their analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConcentration and Markups in International Trade

Alviarez Vanessa, Fioretti Michele, Kikkawa Ken et al.

No citations found for this paper.

Comments (0)