Summary

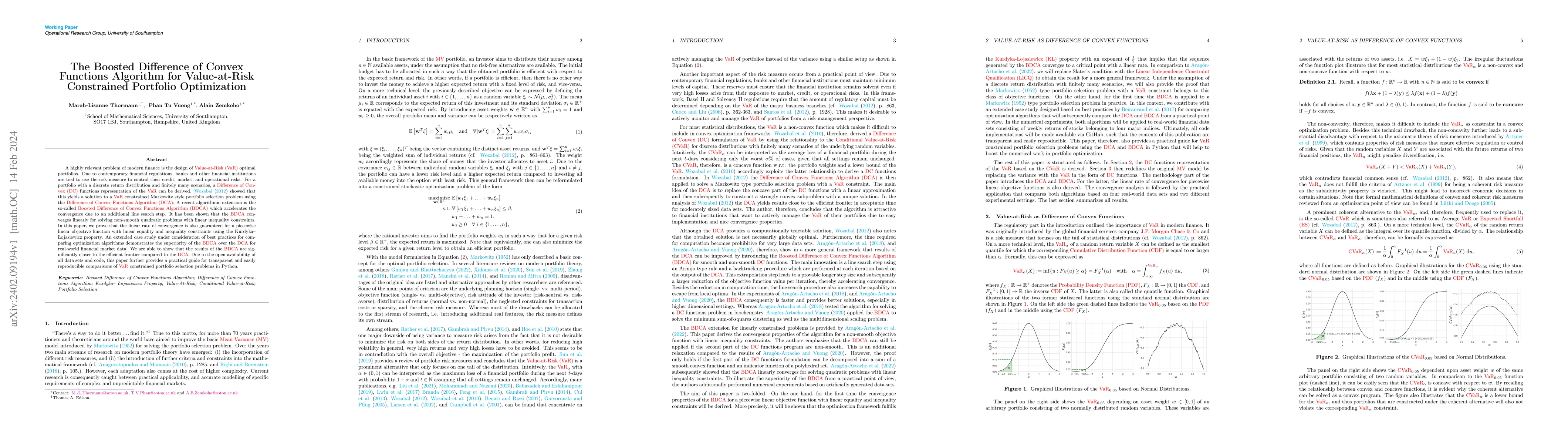

A highly relevant problem of modern finance is the design of Value-at-Risk (VaR) optimal portfolios. Due to contemporary financial regulations, banks and other financial institutions are tied to use the risk measure to control their credit, market and operational risks. For a portfolio with a discrete return distribution and finitely many scenarios, a Difference of Convex (DC) functions representation of the VaR can be derived. Wozabal (2012) showed that this yields a solution to a VaR constrained Markowitz style portfolio selection problem using the Difference of Convex Functions Algorithm (DCA). A recent algorithmic extension is the so-called Boosted Difference of Convex Functions Algorithm (BDCA) which accelerates the convergence due to an additional line search step. It has been shown that the BDCA converges linearly for solving non-smooth quadratic problems with linear inequality constraints. In this paper, we prove that the linear rate of convergence is also guaranteed for a piecewise linear objective function with linear equality and inequality constraints using the Kurdyka-{\L}ojasiewicz property. An extended case study under consideration of best practices for comparing optimization algorithms demonstrates the superiority of the BDCA over the DCA for real-world financial market data. We are able to show that the results of the BDCA are significantly closer to the efficient frontier compared to the DCA. Due to the open availability of all data sets and code, this paper further provides a practical guide for transparent and easily reproducible comparisons of VaR constrained portfolio selection problems in Python.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersAn Inexact Boosted Difference of Convex Algorithm for Nondifferentiable Functions

Boris S. Mordukhovich, Orizon P. Ferreira, Wilkreffy M. S. Santos et al.

No citations found for this paper.

Comments (0)