Summary

The implied volatility is a crucial element of any financial toolbox, since it is used for quoting and the hedging of options as well as for model calibration. In contrast to the Black-Scholes formula its inverse, the implied volatility, is not explicitly available and numerical approximation is required. We propose a bivariate interpolation of the implied volatility surface based on Chebyshev polynomials. This yields a closed-form approximation of the implied volatility, which is easy to implement and to maintain. We prove a subexponential error decay. This allows us to obtain an accuracy close to machine precision with polynomials of a low degree. We compare the performance of the method in terms of runtime and accuracy to the most common reference methods. In contrast to existing interpolation methods, the proposed method is able to compute the implied volatility for all relevant option data. In this context, numerical experiments confirm a considerable increase in efficiency, especially for large data sets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

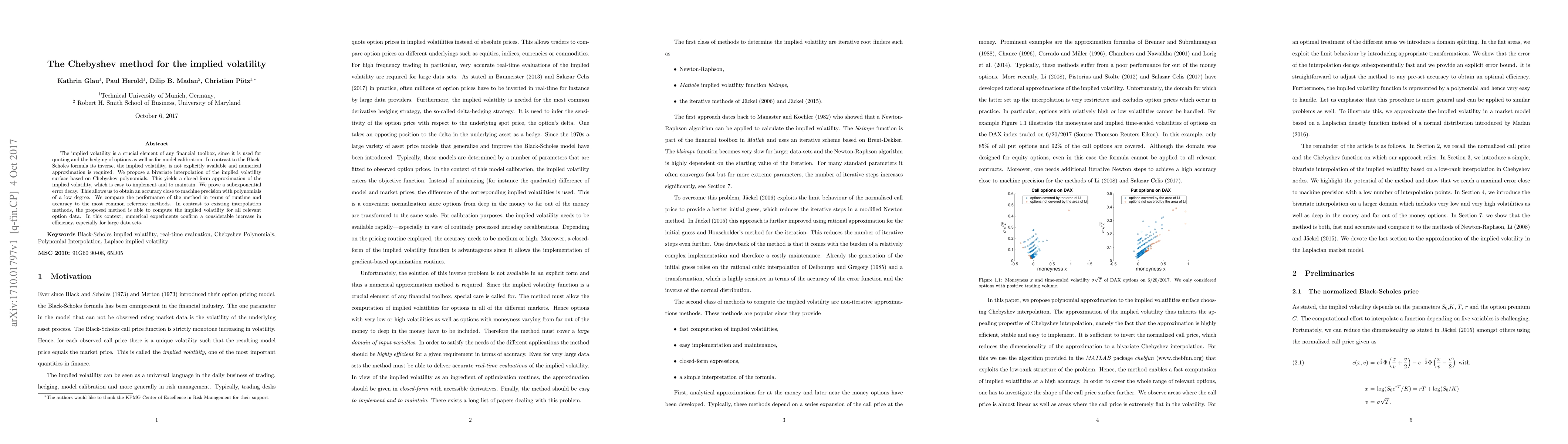

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)