Summary

This paper explores the continuous-time limit of a class of Quasi Score-Driven (QSD) models that characterize volatility. As the sampling frequency increases and the time interval tends to zero, the model weakly converges to a continuous-time stochastic volatility model where the two Brownian motions are correlated, thereby capturing the leverage effect in the market. Subsequently, we identify that a necessary condition for non-degenerate correlation is that the distribution of driving innovations differs from that of computing score, and at least one being asymmetric. We then illustrate this with two typical examples. As an application, the QSD model is used as an approximation for correlated stochastic volatility diffusions and quasi maximum likelihood estimation is performed. Simulation results confirm the method's effectiveness, particularly in estimating the correlation coefficient.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

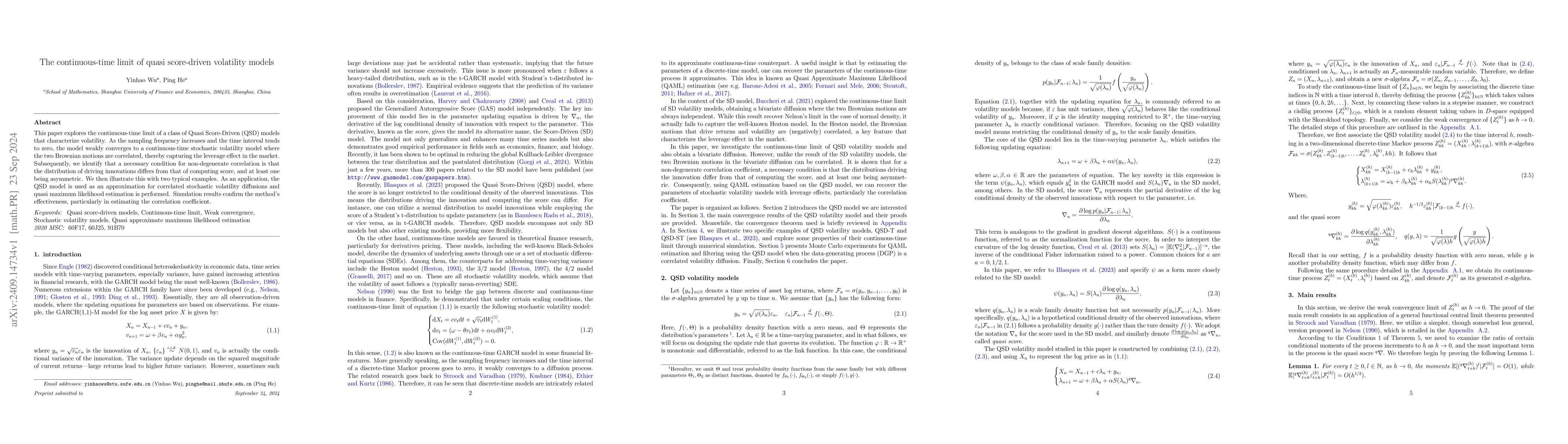

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)