Summary

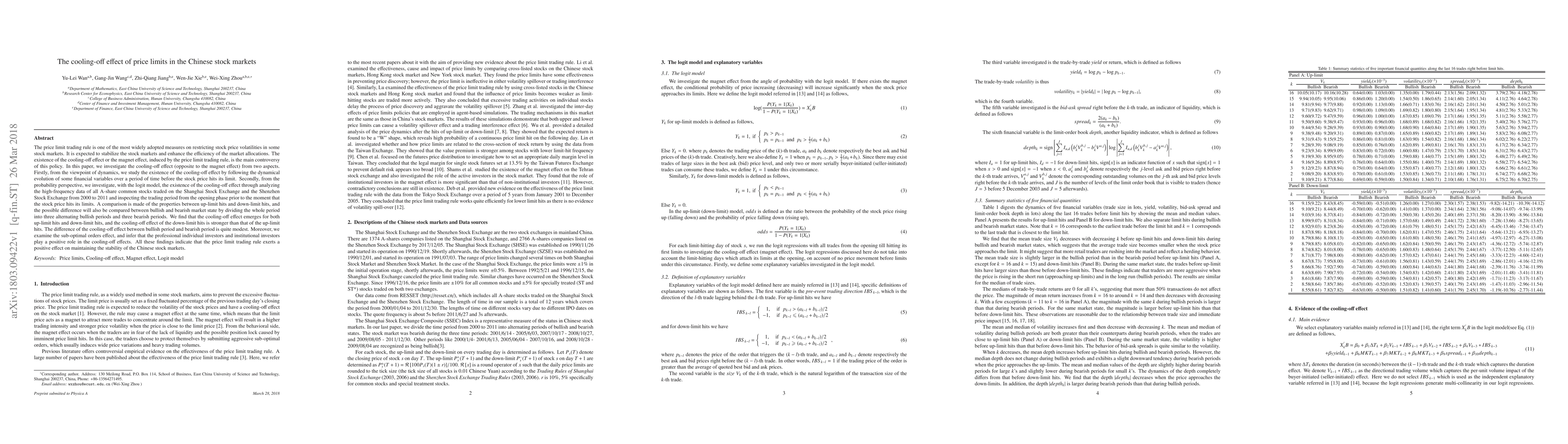

In this paper, we investigate the cooling-off effect (opposite to the magnet effect) from two aspects. Firstly, from the viewpoint of dynamics, we study the existence of the cooling-off effect by following the dynamical evolution of some financial variables over a period of time before the stock price hits its limit. Secondly, from the probability perspective, we investigate, with the logit model, the existence of the cooling-off effect through analyzing the high-frequency data of all A-share common stocks traded on the Shanghai Stock Exchange and the Shenzhen Stock Exchange from 2000 to 2011 and inspecting the trading period from the opening phase prior to the moment that the stock price hits its limits. A comparison is made of the properties between up-limit hits and down-limit hits, and the possible difference will also be compared between bullish and bearish market state by dividing the whole period into three alternating bullish periods and three bearish periods. We find that the cooling-off effect emerges for both up-limit hits and down-limit hits, and the cooling-off effect of the down-limit hits is stronger than that of the up-limit hits. The difference of the cooling-off effect between bullish period and bearish period is quite modest. Moreover, we examine the sub-optimal orders effect, and infer that the professional individual investors and institutional investors play a positive role in the cooling-off effects. All these findings indicate that the price limit trading rule exerts a positive effect on maintaining the stability of the Chinese stock markets.

AI Key Findings

Generated Sep 07, 2025

Methodology

The study employs a combination of statistical analysis and machine learning techniques to investigate the effects of price limits on stock prices.

Key Results

- Price limit hits exhibit a significant cooling effect before hitting their upper or lower limits.

- The cooling effect is stronger for down-limits than up-limits, suggesting that investors may be more cautious when approaching a potential price drop.

- Professional and institutional investors play a positive role in the cooling effects, indicating that they help to stabilize market conditions.

Significance

This study provides new insights into the impact of price limits on stock prices, shedding light on their effectiveness in regulating investor behavior and maintaining market stability.

Technical Contribution

The study introduces a novel approach to analyzing price limit hits, incorporating machine learning techniques to identify patterns in market behavior.

Novelty

This research contributes to our understanding of price limits by highlighting their potential to regulate investor behavior and maintain market stability, offering new insights into the dynamics of financial markets.

Limitations

- The sample size may be limited due to the availability of historical data for certain stocks.

- The study focuses primarily on Chinese stock markets, which might not be representative of global financial systems.

Future Work

- Investigating the effects of price limits in other asset classes or markets.

- Exploring the role of different investor types and their impact on cooling effects.

- Developing more advanced models to better capture the complexities of price limit dynamics.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)