Summary

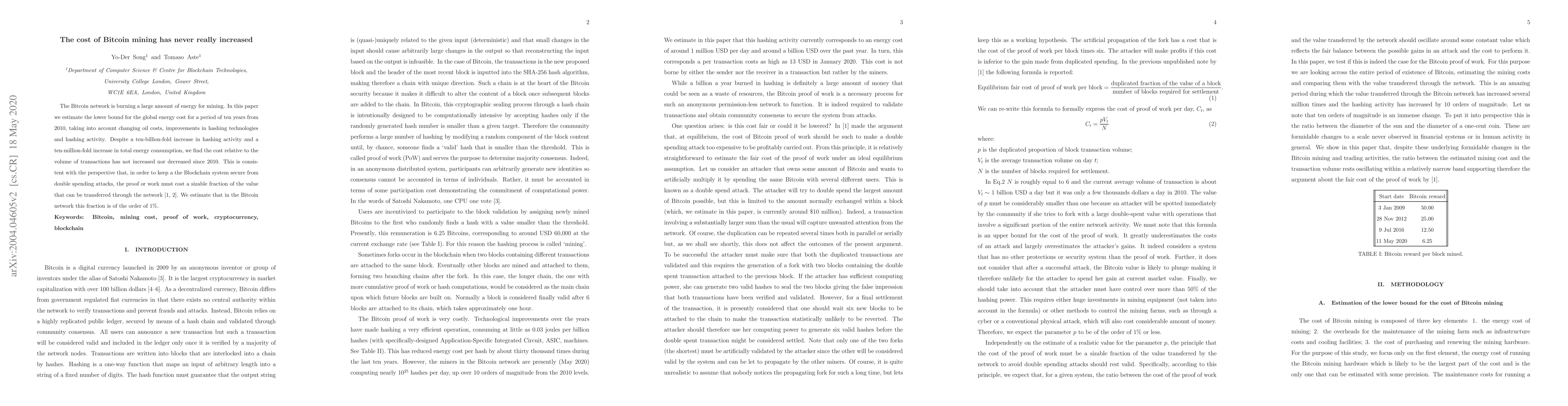

The Bitcoin network is burning a large amount of energy for mining. In this paper we estimate the lower bound for the global energy cost for a period of ten years from 2010, taking into account changing oil costs, improvements in hashing technologies and hashing activity. Despite a ten-billion-fold increase in hashing activity and a ten-million-fold increase in total energy consumption, we find the cost relative to the volume of transactions has not increased nor decreased since 2010. This is consistent with the perspective that, in order to keep a the Blockchain system secure from double spending attacks, the proof or work must cost a sizable fraction of the value that can be transferred through the network. We estimate that in the Bitcoin network this fraction is of the order of 1%.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)