Summary

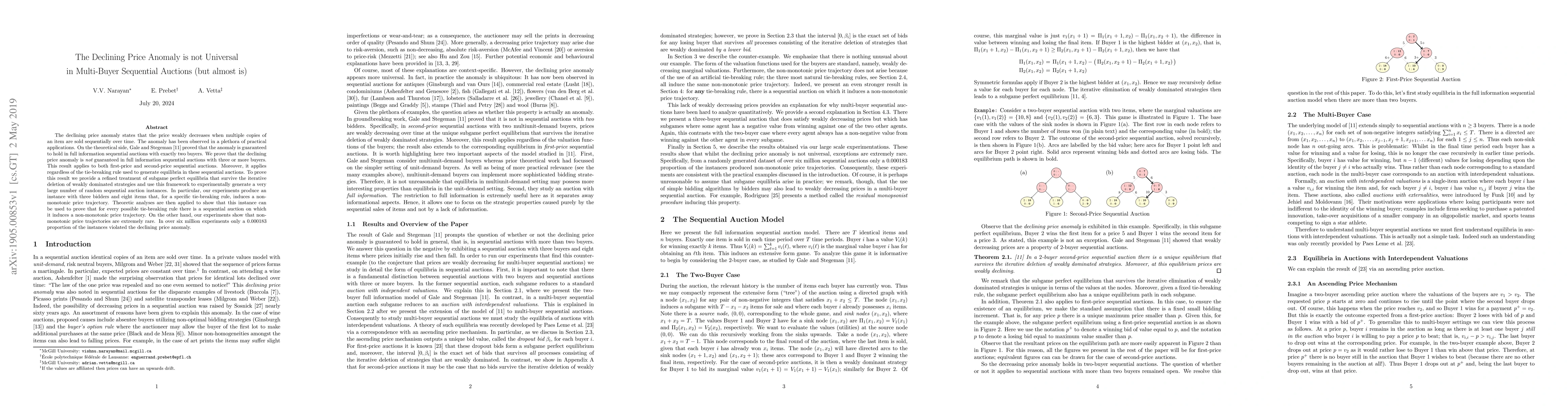

The declining price anomaly states that the price weakly decreases when multiple copies of an item are sold sequentially over time. The anomaly has been observed in a plethora of practical applications. On the theoretical side, Gale and Stegeman proved that the anomaly is guaranteed to hold in full information sequential auctions with exactly two buyers. We prove that the declining price anomaly is not guaranteed in full information sequential auctions with three or more buyers. This result applies to both first-price and second-price sequential auctions. Moreover, it applies regardless of the tie-breaking rule used to generate equilibria in these sequential auctions. To prove this result we provide a refined treatment of subgame perfect equilibria that survive the iterative deletion of weakly dominated strategies and use this framework to experimentally generate a very large number of random sequential auction instances. In particular, our experiments produce an instance with three bidders and eight items that, for a specific tie-breaking rule, induces a non-monotonic price trajectory. Theoretic analyses are then applied to show that this instance can be used to prove that for every possible tie-breaking rule there is a sequential auction on which it induces a non-monotonic price trajectory. On the other hand, our experiments show that non-monotonic price trajectories are extremely rare. In over six million experiments only a 0.000183 proportion of the instances violated the declining price anomaly.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrice Manipulability in First-Price Auctions

Paul Dütting, Balasubramanian Sivan, Johannes Brustle

| Title | Authors | Year | Actions |

|---|

Comments (0)