Authors

Summary

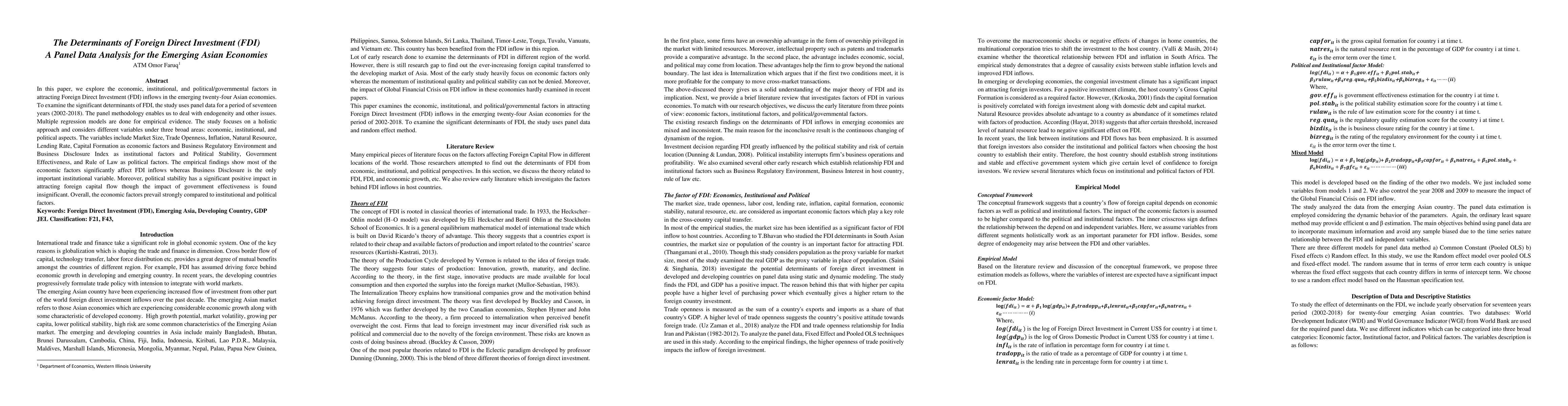

In this paper, we explore the economic, institutional, and political/governmental factors in attracting Foreign Direct Investment (FDI) inflows in the emerging twenty-four Asian economies. To examine the significant determinants of FDI, the study uses panel data for a period of seventeen years (2002-2018). The panel methodology enables us to deal with endogeneity and other issues. Multiple regression models are done for empirical evidence. The study focuses on a holistic approach and considers different variables under three broad areas: economic, institutional, and political aspects. The variables include Market Size, Trade Openness, Inflation, Natural Resource, Lending Rate, Capital Formation as economic factors and Business Regulatory Environment and Business Disclosure Index as institutional factors and Political Stability, Government Effectiveness, and Rule of Law as political factors. The empirical findings show most of the economic factors significantly affect FDI inflows whereas Business Disclosure is the only important institutional variable. Moreover, political stability has a significant positive impact in attracting foreign capital flow though the impact of government effectiveness is found insignificant. Overall, the economic factors prevail strongly compared to institutional and political factors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Effects of COVID-19 and the Russia-Ukraine War on Inward Foreign Direct Investment

MS Hosen, SM Hossain, MN Mia et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)