Authors

Summary

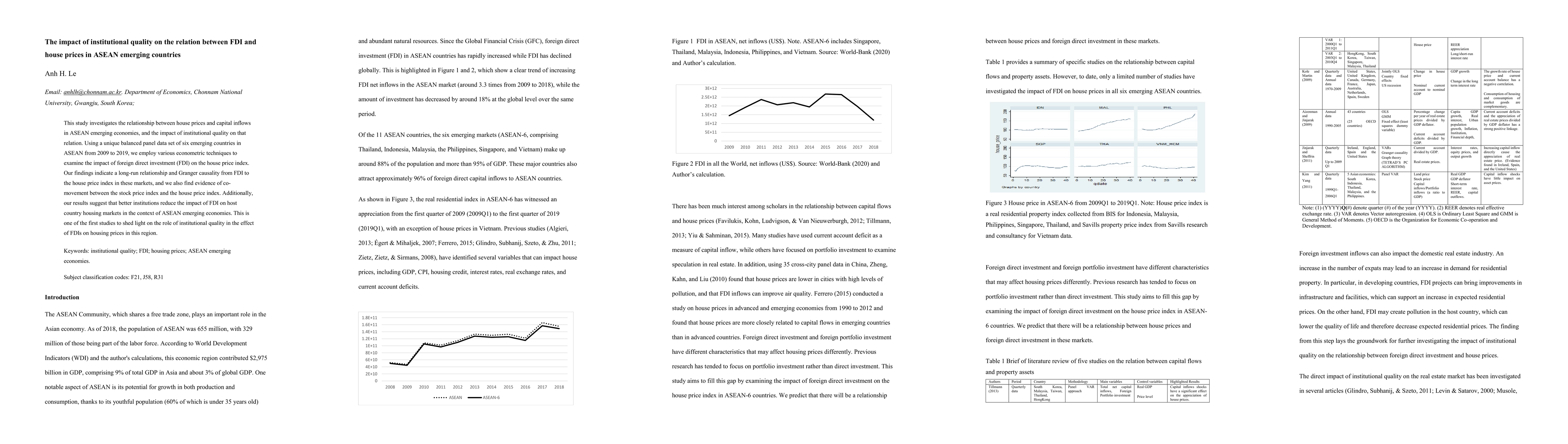

This study investigates the relationship between house prices and capital inflows in ASEAN emerging economies, and the impact of institutional quality on that relation. Using a unique balanced panel data set of six emerging countries in ASEAN from 2009 to 2019, we employ various econometric techniques to examine the impact of foreign direct investment (FDI) on the house price index. Our findings indicate a long-run relationship and Granger causality from FDI to the house price index in these markets, and we also find evidence of co-movement between the stock price index and the house price index. Additionally, our results suggest that better institutions reduce the impact of FDI on host country housing markets in the context of ASEAN emerging economies. This is one of the first studies to shed light on the role of institutional quality in the effect of FDIs on housing prices in this region.

AI Key Findings

Generated Jun 09, 2025

Methodology

The study employs panel cointegration tests (Kao, 1999; Pedroni, 1999, 2004), Dumitrescu and Hurlin (2012) Granger non-causality test, panel fully modified ordinary least squares (FMOLS), panel mean group (PMG) estimation, and panel fixed-effect regression with error-correction models (ECM) to analyze the relationship between house prices and FDI in ASEAN-6 countries.

Key Results

- There is a long-run relationship and Granger causality from FDI to house price index in ASEAN emerging economies.

- Better institutions reduce the impact of FDI on host country housing markets.

- Higher FDI inflows likely accelerate house prices in the long run.

Significance

This research is significant as it contributes to understanding the impact of FDI on housing prices in ASEAN emerging markets, providing insights for policymakers to adjust laws and regulations for better economic freedom and reduced sensitivity to foreign capital inflows.

Technical Contribution

The paper introduces a comprehensive analysis using various panel data econometric techniques to study the relationship between FDI, institutional quality, and house prices in ASEAN emerging economies.

Novelty

This study is among the first to examine the role of institutional quality in the effect of FDIs on housing prices in the ASEAN region.

Limitations

- The study focuses on ASEAN-6 countries, limiting generalizability to other regions.

- Data availability and quality may influence the robustness of findings.

Future Work

- Further research can expand the analysis to other emerging markets outside ASEAN.

- Investigating the impact of other types of capital inflows on housing prices.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)