Summary

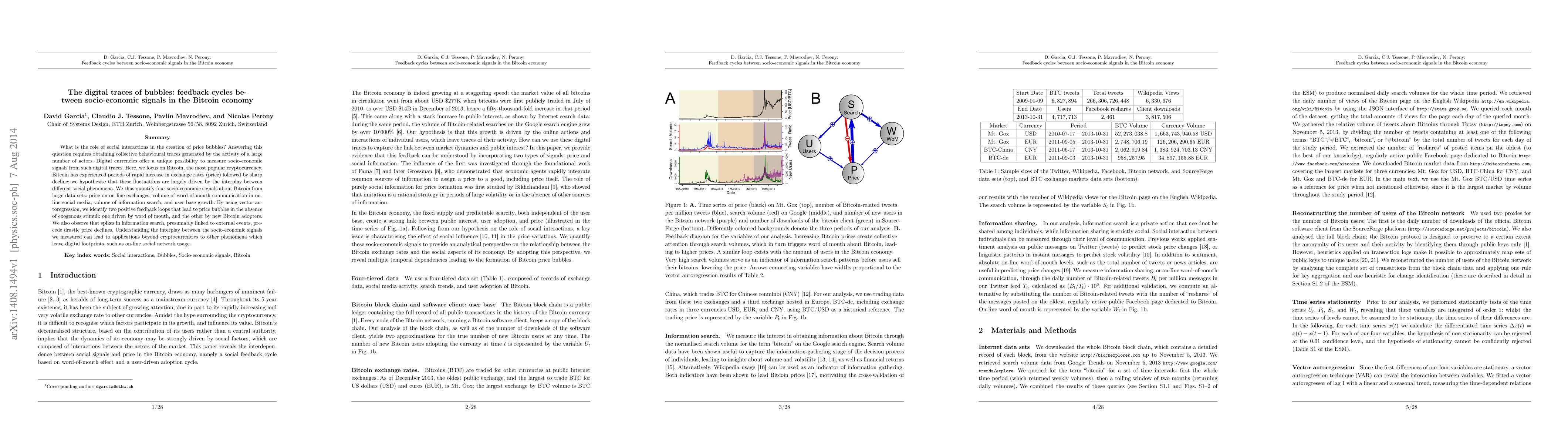

What is the role of social interactions in the creation of price bubbles? Answering this question requires obtaining collective behavioural traces generated by the activity of a large number of actors. Digital currencies offer a unique possibility to measure socio-economic signals from such digital traces. Here, we focus on Bitcoin, the most popular cryptocurrency. Bitcoin has experienced periods of rapid increase in exchange rates (price) followed by sharp decline; we hypothesise that these fluctuations are largely driven by the interplay between different social phenomena. We thus quantify four socio-economic signals about Bitcoin from large data sets: price on on-line exchanges, volume of word-of-mouth communication in on-line social media, volume of information search, and user base growth. By using vector autoregression, we identify two positive feedback loops that lead to price bubbles in the absence of exogenous stimuli: one driven by word of mouth, and the other by new Bitcoin adopters. We also observe that spikes in information search, presumably linked to external events, precede drastic price declines. Understanding the interplay between the socio-economic signals we measured can lead to applications beyond cryptocurrencies to other phenomena which leave digital footprints, such as on-line social network usage.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Relationship between Digital RMB and Digital Economy in China

Chang Su, Wenbo Lyu, Yueting Liu

| Title | Authors | Year | Actions |

|---|

Comments (0)