Summary

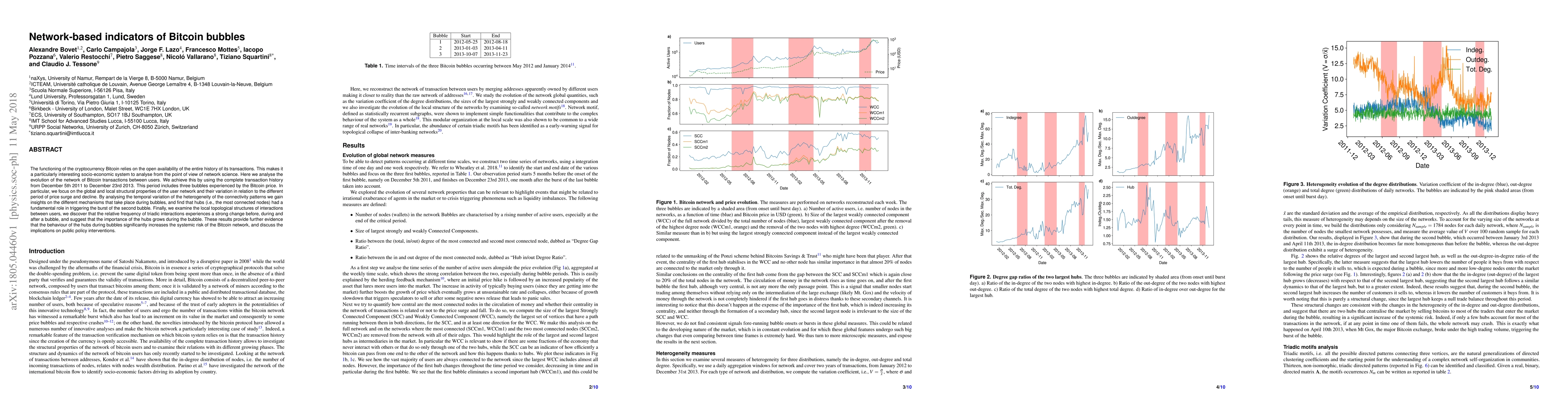

The functioning of the cryptocurrency Bitcoin relies on the open availability of the entire history of its transactions. This makes it a particularly interesting socio-economic system to analyse from the point of view of network science. Here we analyse the evolution of the network of Bitcoin transactions between users. We achieve this by using the complete transaction history from December 5th 2011 to December 23rd 2013. This period includes three bubbles experienced by the Bitcoin price. In particular, we focus on the global and local structural properties of the user network and their variation in relation to the different period of price surge and decline. By analysing the temporal variation of the heterogeneity of the connectivity patterns we gain insights on the different mechanisms that take place during bubbles, and find that hubs (i.e., the most connected nodes) had a fundamental role in triggering the burst of the second bubble. Finally, we examine the local topological structures of interactions between users, we discover that the relative frequency of triadic interactions experiences a strong change before, during and after a bubble, and suggest that the importance of the hubs grows during the bubble. These results provide further evidence that the behaviour of the hubs during bubbles significantly increases the systemic risk of the Bitcoin network, and discuss the implications on public policy interventions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)