Authors

Summary

We present a dynamical many-body theory of money in which the value of money is a time dependent ``strategic variable'' that is chosen by the individual agents. The value of money in equilibrium is not fixed by the equations, and thus represents a continuous symmetry. The dynamics breaks this continuous symmetry by fixating the value of money at a level which depends on initial conditions. The fluctuations around the equilibrium, for instance in the presence of noise, are governed by the ``Goldstone modes'' associated with the broken symmetry. The idea is illustrated by a simple network model of monopolistic vendors and buyers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

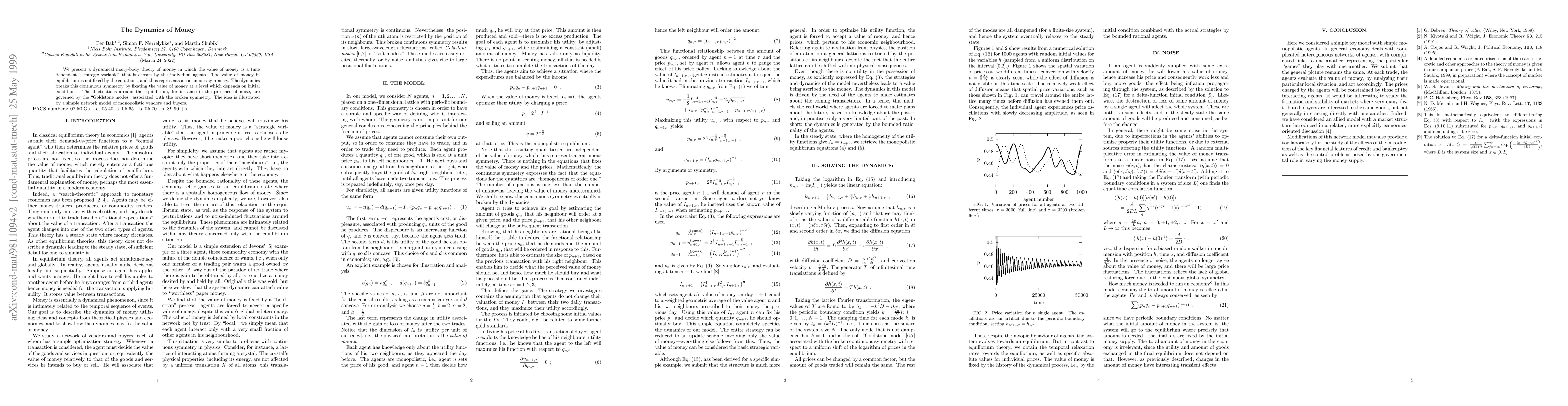

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)