Summary

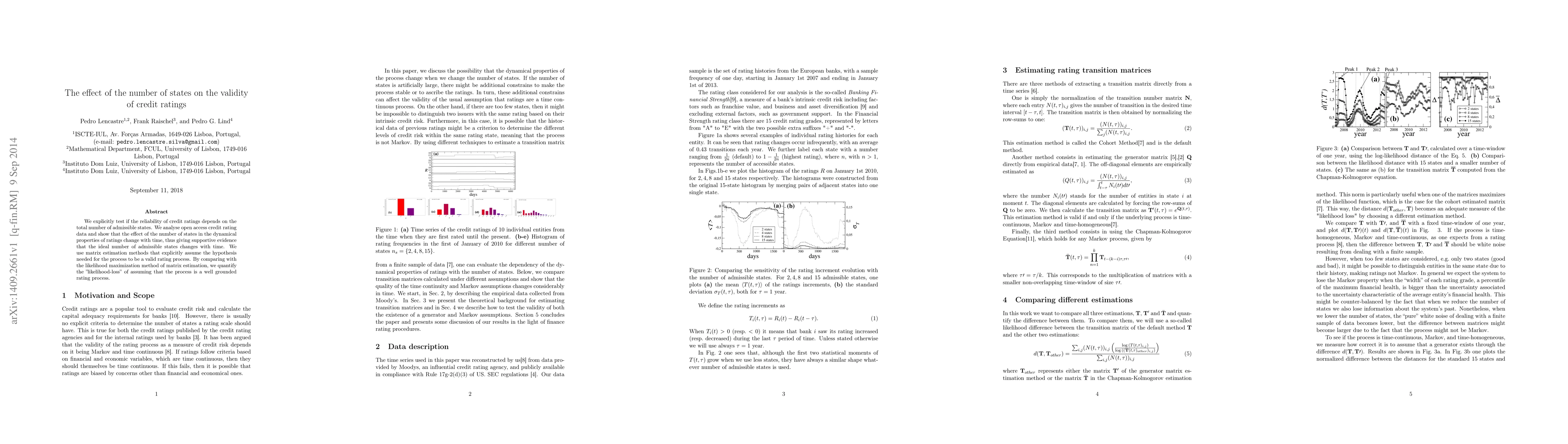

We explicitly test if the reliability of credit ratings depends on the total number of admissible states. We analyse open access credit rating data and show that the effect of the number of states in the dynamical properties of ratings change with time, thus giving supportive evidence that the ideal number of admissible states changes with time. We use matrix estimation methods that explicitly assume the hypothesis needed for the process to be a valid rating process. By comparing with the likelihood maximization method of matrix estimation, we quantify the "likelihood-loss" of assuming that the process is a well grounded rating process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Ratings: Heterogeneous Effect on Capital Structure

Helmut Wasserbacher, Martin Spindler

The Impact of Implicit Government Guarantee on Credit Rating of Municipal Investment Bonds

Yan Zhang, Lin Chen, Yixiang Tian

No citations found for this paper.

Comments (0)