Authors

Summary

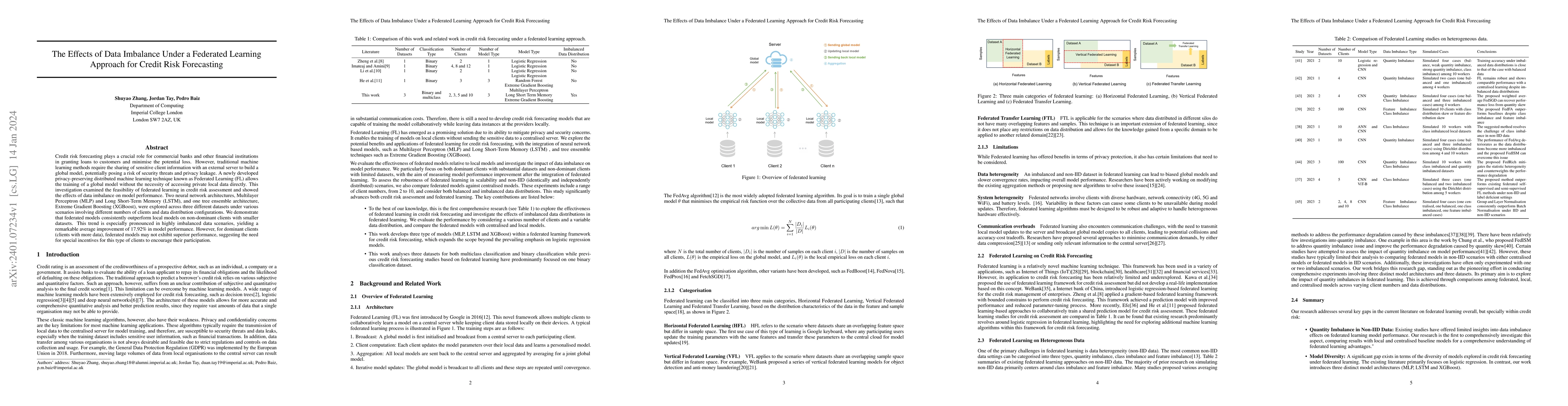

Credit risk forecasting plays a crucial role for commercial banks and other financial institutions in granting loans to customers and minimise the potential loss. However, traditional machine learning methods require the sharing of sensitive client information with an external server to build a global model, potentially posing a risk of security threats and privacy leakage. A newly developed privacy-preserving distributed machine learning technique known as Federated Learning (FL) allows the training of a global model without the necessity of accessing private local data directly. This investigation examined the feasibility of federated learning in credit risk assessment and showed the effects of data imbalance on model performance. Two neural network architectures, Multilayer Perceptron (MLP) and Long Short-Term Memory (LSTM), and one tree ensemble architecture, Extreme Gradient Boosting (XGBoost), were explored across three different datasets under various scenarios involving different numbers of clients and data distribution configurations. We demonstrate that federated models consistently outperform local models on non-dominant clients with smaller datasets. This trend is especially pronounced in highly imbalanced data scenarios, yielding a remarkable average improvement of 17.92% in model performance. However, for dominant clients (clients with more data), federated models may not exhibit superior performance, suggesting the need for special incentives for this type of clients to encourage their participation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersToward Fair Federated Learning under Demographic Disparities and Data Imbalance

Nan Liu, Siqi Li, Qiming Wu et al.

Wind Power Forecasting Considering Data Privacy Protection: A Federated Deep Reinforcement Learning Approach

Yang Li, Meng Zhang, Yuanzheng Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)