Summary

This work presents a theoretical and empirical evaluation of Anderson-Darling test when the sample size is limited. The test can be applied in order to backtest the risk factors dynamics in the context of Counterparty Credit Risk modelling. We show the limits of such test when backtesting the distributions of an interest rate model over long time horizons and we propose a modified version of the test that is able to detect more efficiently an underestimation of the model's volatility. Finally we provide an empirical application.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

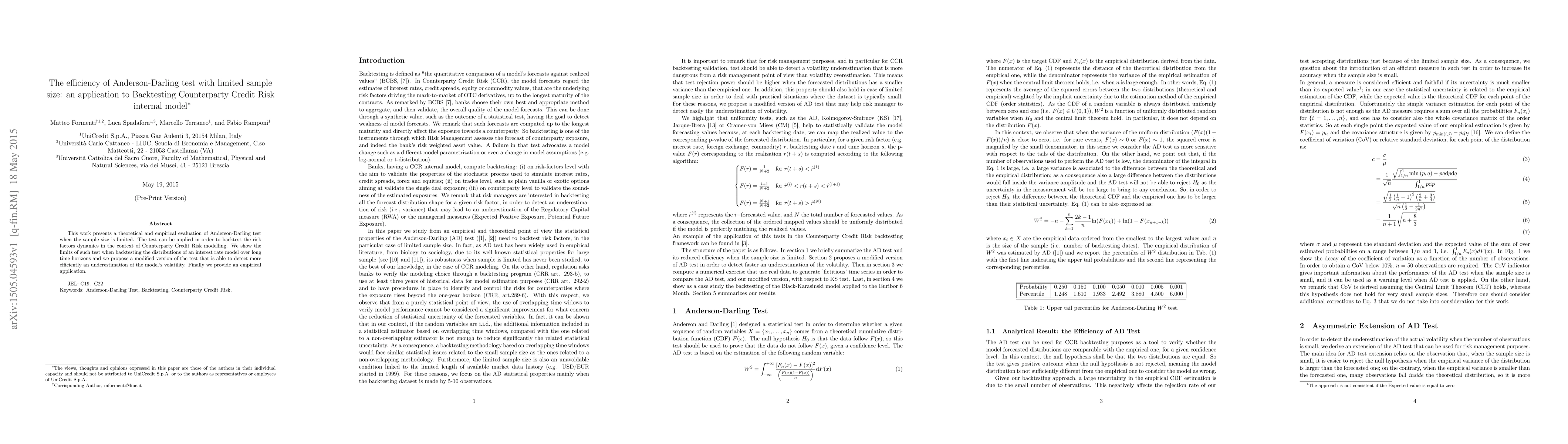

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)