Summary

Considering a simple economy, we derive a new Hamilton-Jacobi equation which is satisfied by the value of a ''bubble'' asset. We then show, by providing a rigorous mathematical analysis of this equation, that a unique non-zero stable solution exists under certain assumptions. The economic interpretation of this result is that, if the bubble asset can produce more stable returns than fiat money, agents protect themselves from hazardous situations through the bubble asset, thus forming a bubble's consensus value. Our mathematical analysis uses different ideas coming from the study of semi-linear elliptic equations.

AI Key Findings

Generated Jun 07, 2025

Methodology

The paper derives a new Hamilton-Jacobi equation for bubble assets in a simple economy and analyzes it using semi-linear elliptic equations.

Key Results

- A unique non-zero stable solution exists for the bubble asset's value under certain assumptions.

- Bubble assets can provide more stable returns than fiat money, leading to a consensus value formed by agents protecting themselves from hazardous situations.

Significance

This research contributes to understanding the formation and stability of bubble consensus values, which can have implications for financial market stability and risk management.

Technical Contribution

The paper presents a rigorous mathematical analysis of a Hamilton-Jacobi equation for bubble assets, providing conditions for a unique stable solution.

Novelty

The approach combines ideas from economics and the study of semi-linear elliptic equations to analyze bubble asset pricing, offering new insights into bubble consensus value formation.

Limitations

- The study is based on a simple economy model, which may not fully capture the complexities of real-world financial markets.

- Assumptions made for the mathematical analysis might not hold in more intricate economic scenarios.

Future Work

- Explore the applicability of the findings in more complex economic models.

- Investigate the behavior of bubble assets under various market conditions and regulatory environments.

Paper Details

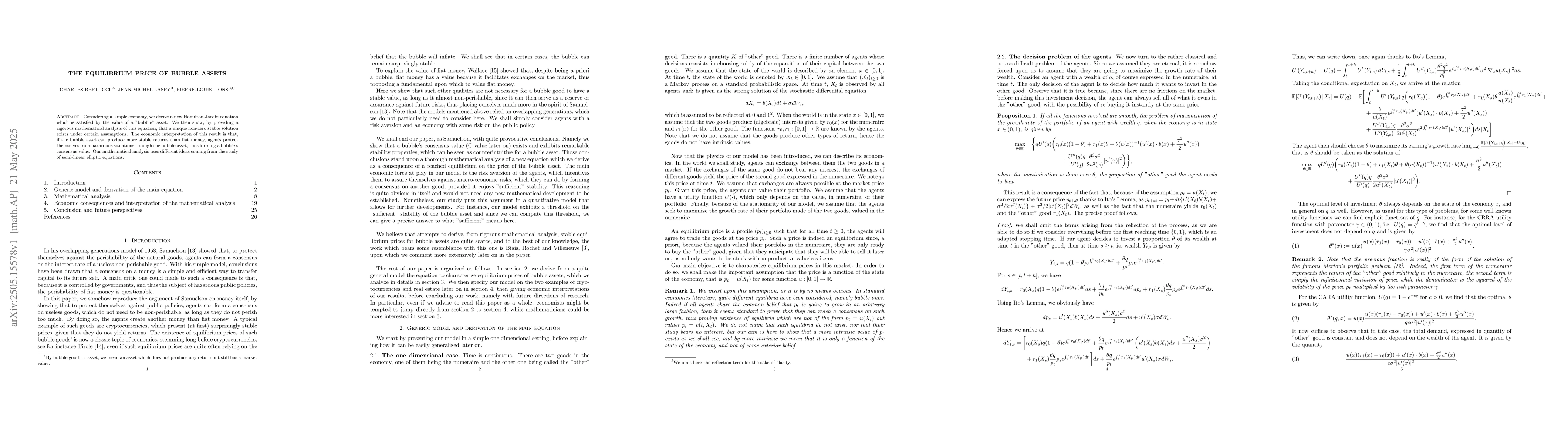

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)