Summary

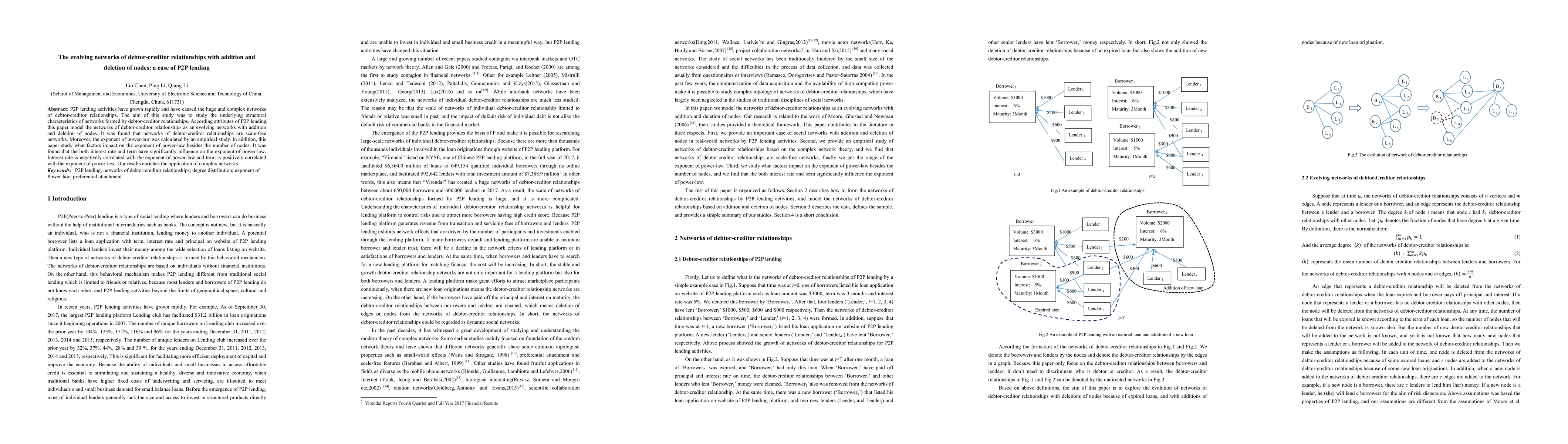

P2P lending activities have grown rapidly and have caused the huge and complex networks of debtor-creditor relationships. The aim of this study was to study the underlying structural characteristics of networks formed by debtor-creditor relationships. According attributes of P2P lending, this paper model the networks of debtor-creditor relationships as an evolving networks with addition and deletion of nodes. It was found that networks of debtor-creditor relationships are scale-free networks. Moreover, the exponent of power-law was calculated by an empirical study. In addition, this paper study what factors impact on the exponent of power-law besides the number of nodes. It was found that the both interest rate and term have significantly influence on the exponent of power-law. Interest rate is negatively correlated with the exponent of power-law and term is positively correlated with the exponent of power-law. Our results enriches the application of complex networks

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExtended SPR for Evolving Networks with Nodes Preferential Deletion

Xiaojun Zhang, YueXiao

Predicting Failure of P2P Lending Platforms through Machine Learning: The Case in China

Jen-Yin Yeh, Hsin-Yu Chiu, Jhih-Huei Huang

No citations found for this paper.

Comments (0)