Authors

Summary

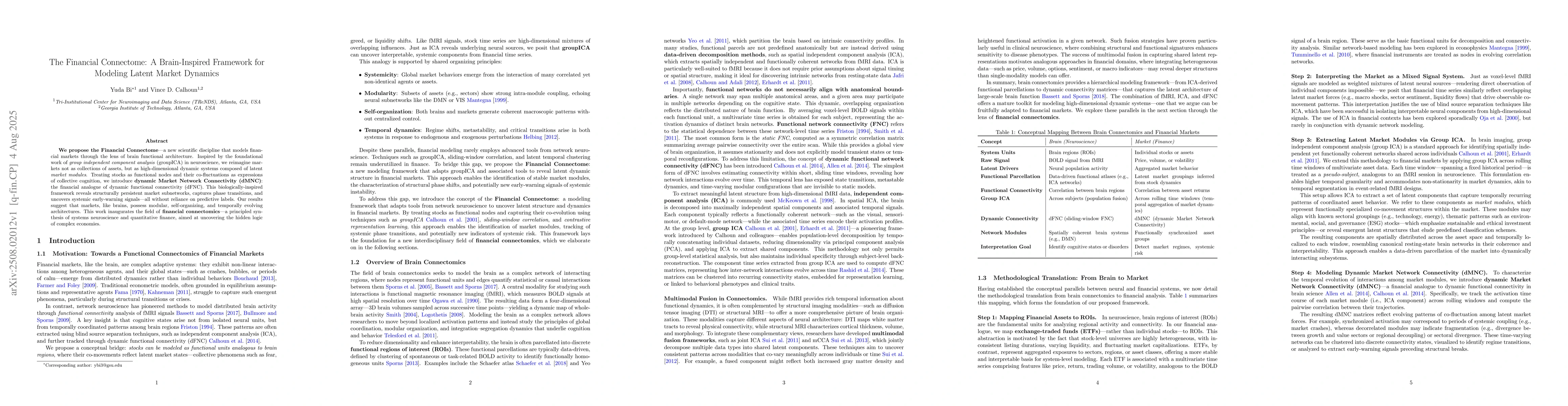

We propose the Financial Connectome, a new scientific discipline that models financial markets through the lens of brain functional architecture. Inspired by the foundational work of group independent component analysis (groupICA) in neuroscience, we reimagine markets not as collections of assets, but as high-dimensional dynamic systems composed of latent market modules. Treating stocks as functional nodes and their co-fluctuations as expressions of collective cognition, we introduce dynamic Market Network Connectivity (dMNC), the financial analogue of dynamic functional connectivity (dFNC). This biologically inspired framework reveals structurally persistent market subnetworks, captures regime shifts, and uncovers systemic early warning signals all without reliance on predictive labels. Our results suggest that markets, like brains, exhibit modular, self-organizing, and temporally evolving architectures. This work inaugurates the field of financial connectomics, a principled synthesis of systems neuroscience and quantitative finance aimed at uncovering the hidden logic of complex economies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersMachine Learning Based Stress Testing Framework for Indian Financial Market Portfolios

Siddhartha P. Chakrabarty, Vidya Sagar G, Shifat Ali

Unveiling and Steering Connectome Organization with Interpretable Latent Variables

Xingyu Liu, Yubin Li, Guozhang Chen

Advanced Digital Simulation for Financial Market Dynamics: A Case of Commodity Futures

Cheng Wang, Changjun Jiang, Chuwen Wang et al.

Comments (0)