Summary

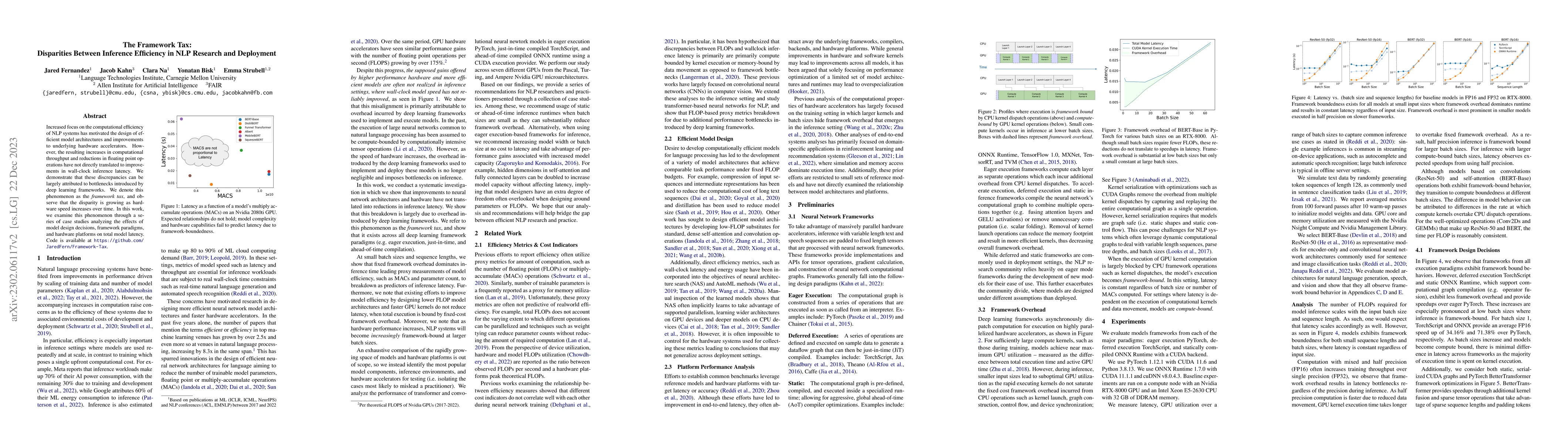

Increased focus on the computational efficiency of NLP systems has motivated the design of efficient model architectures and improvements to underlying hardware accelerators. However, the resulting increases in computational throughput and reductions in floating point operations have not directly translated to improvements in wall-clock inference latency. We demonstrate that these discrepancies can be largely attributed to bottlenecks introduced by deep learning frameworks. We denote this phenomenon as the \textit{framework tax}, and observe that the disparity is growing as hardware speed increases over time. In this work, we examine this phenomenon through a series of case studies analyzing the effects of model design decisions, framework paradigms, and hardware platforms on total model latency. Code is available at https://github.com/JaredFern/Framework-Tax.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGeographic Citation Gaps in NLP Research

Diyi Yang, Saif M. Mohammad, Mukund Rungta et al.

Towards Sustainable NLP: Insights from Benchmarking Inference Energy in Large Language Models

Niloy Ganguly, Saptarshi Ghosh, Soham Poddar et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)