Summary

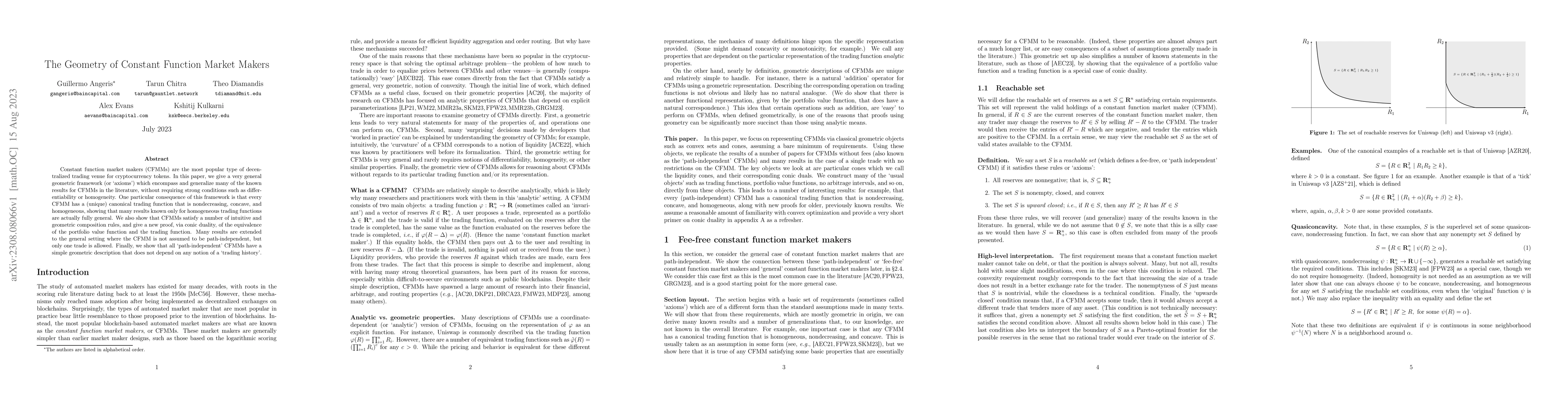

Constant function market makers (CFMMs) are the most popular type of decentralized trading venue for cryptocurrency tokens. In this paper, we give a very general geometric framework (or 'axioms') which encompass and generalize many of the known results for CFMMs in the literature, without requiring strong conditions such as differentiability or homogeneity. One particular consequence of this framework is that every CFMM has a (unique) canonical trading function that is nondecreasing, concave, and homogeneous, showing that many results known only for homogeneous trading functions are actually fully general. We also show that CFMMs satisfy a number of intuitive and geometric composition rules, and give a new proof, via conic duality, of the equivalence of the portfolio value function and the trading function. Many results are extended to the general setting where the CFMM is not assumed to be path-independent, but only one trade is allowed. Finally, we show that all 'path-independent' CFMMs have a simple geometric description that does not depend on any notion of a 'trading history'.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAxioms for Constant Function Market Makers

Mateusz Kwaśnicki, Akaki Mamageishvili, Jan Christoph Schlegel

The Pricing And Hedging Of Constant Function Market Makers

Richard Dewey, Craig Newbold

Optimal Routing for Constant Function Market Makers

Alex Evans, Stephen Boyd, Guillermo Angeris et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)